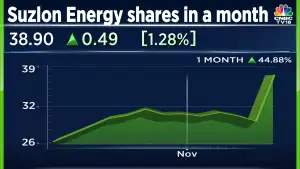

Suzlon Energy shares are up nearly 2% on Monday and are trading near the mark of ₹40, ahead of the potential inclusion in the MSCI Global Standard Index on Tuesday.

MSCI will announce the results of its semi-annual index review on November 14, 2023.

In case the stock is expected to see potential inflows of $186 million, according to JM Financial’s note.

Sulzon Energy has witnessed a remarkable rally throughout the year, making it a compelling candidate for inclusion in the MSCI review. The company’s success and growth are expected to attract significant attention from investors.

, according to Nuvama.

The official changes will be announced by AMFI in the first week of January next year and will be applicable from February to July 2024.

On Monday, shares of Suzlon Energy are trading 1.22% higher at ₹38.88 apiece on BSE. The stock has more than tripled since the beginning of this year. This is its best annual performance in a calendar year, surpassing the 246% it had gained in 2020 for four years in a row.

The scrip has gained 45% in the last one month. On a year-to-date basis, the stock has rallied 263% while it has climbed 370% in the last year.

The stock made its market debut in late 2005 at a price of over ₹500. Since then, Suzlon Energy shares declined to as low as ₹2 in 2019 before recovering.

Technically, the 14-day relative strength index (RSI) of the counter stood at 79.0. RSI above 70 is considered overbought, implying that the stock may show a pullback.

The stock has a one-year beta of 1.7, indicating very high volatility during the period. Suzlon shares are trading higher than 5-day, 20-day, 50-day, 150-day and 200-day moving averages.

Speaking to CNBC-TV18 in a post-earnings interaction, the company’s Chief Financial Officer (CFO) Himanshu Mody said that Suzlon Energy is not on the block.

Suzlon now has a net debt-free balance sheet after its recent Qualified Institutional Placement. In fact, it has a net cash surplus of ₹600 crore on its books.