With main indices, the broader indices also extended the losing streak on the second consecutive week ended November 14, with mid- and small-cap indices falling 4 percent each.

The benchmark extended the profit booking with 2.5 percent fall in this week, amid by consistent FII selling, muted earnings from India Inc and concern over rising inflation.

This week, BSE Sensex declined 1,906.01 points or2.39 percent to close at 77,580.31, while the Nifty50 index shed 615.5 points or 2.5 percent to finish at 23,532.70.

The BSE Mid-cap Index, BSE Small-cap and BSE Large-cap Index, indices fell 3.9 percent, 4.6 percent and 2.6 percent, respectively.

On the sectoral front, Nifty Metal and PSU Bank indices shed more than 5 percent each, Nifty FMCG and Healthcare indices fell more than 4 percent each, Nifty Auto and Oil & Gas indices slipped nearly 4 percent each. However, Nifty Information Technology index added nearly 1 percent.

Foreign Institutional Investors (FIIs) extended their selling in this week also as they sold equities worth Rs 9,683.64 crore, while Domestic Institutional Investors (DII) also extended their buying as they bought equities worth Rs 12,508.14 crore.

In the month of November till now, the FIIs bought equities worth Rs 29,533.17 crore and DIIs purchased equities worth Rs 26,522.32 crore.

“In this truncated week, the benchmark indices witnessed a sharp correction, the Nifty ends 2.45 percent lower while the Sensex was down nearly 2000 points. Among Sectors, almost all the major sectoral indices registered profit booking at higher levels but Metal index lost the most, shed over 5 percent. During the week, market slipped below 24000/79000 and post breakdown the selling pressure intensified. Technically, on weekly charts, it has formed long bearish candle and on daily charts, it is holding lower top formation, which is largely negative,” said Amol Athawale, VP-Technical Research, Kotak Securities.

“We are of the view that, the current market texture is weak but oversold, for the positional traders now, 200 day SMA or 23500/77400 (Simple Moving Average) would act as a sacrosanct support zone. Above the same, we could expect one quick technical pullback rally. On the higher side, the market could bounce back till 23800-24000/78500-79000. However, dismissal of 23500/77400 could trigger further weakness. Below which, it could slip till 23300-23200/77000-76600.”

“For Bank Nifty traders also 200 day SMA or 49750 would be the key support zone. if it sustain above the same, then it could move up till 50900-51200. However, below 49750 or 200 day SMA the sentiment could change. Below which it could slip till 49300-49000. Short-term traders should remain cautious and be very selective as there is a risk to get trapped at lower levels,” he added.

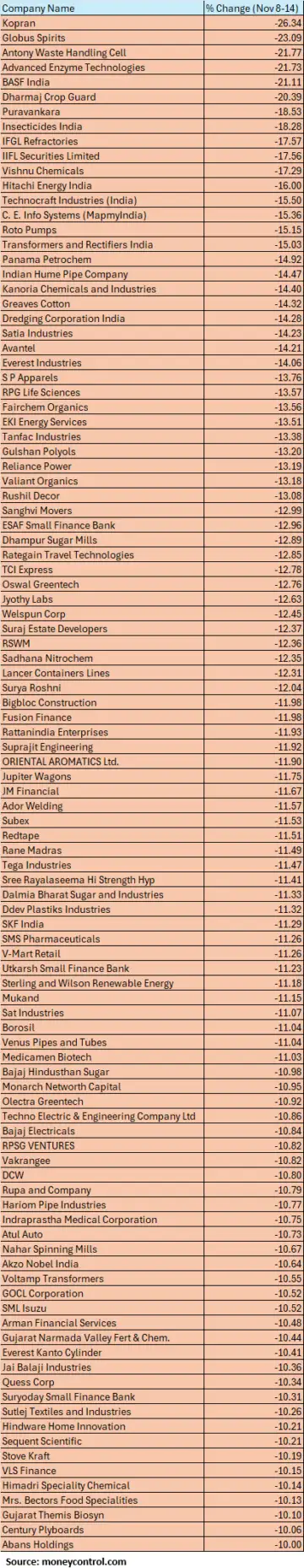

The BSE Small-cap index declined 4.6 percent dragged by Kopran, Globus Spirits, Antony Waste Handling Cell, Advanced Enzyme Technologies, BASF India, Dharmaj Crop Guard, Puravankara, Insecticides India, IFGL Refractories, IIFL Securities, Vishnu Chemicals, Hitachi Energy India, Technocraft Industries (India), C. E. Info Systems (MapmyIndia), Roto Pumps, Transformers and Rectifiers India.

On the other hand, Pix Transmissions, JSW Holdings, Sasken Technologies, Nalwa Sons Investment, Shankara Building Products, Neuland Laboratories, Banco Products (India), Dishman Carbogen Amcis gained between 12-28 percent.

Where is Nifty50 headed?

Amol Athawale, VP-Technical Research, Kotak Securities:

Technically, on weekly charts, it has formed long bearish candle and on daily charts, it is holding lower top formation, which is largely negative. We are of the view that, the current market texture is weak but oversold, for the positional traders now, 200 day SMA or 23500/77400 (Simple Moving Average) would act as a sacrosanct support zone. Above the same, we could expect one quick technical pullback rally. On the higher side, the market could bounce back till 23800-24000/78500-79000. However, dismissal of 23500/77400 could trigger further weakness. Below which, it could slip till 23300-23200/77000-76600.

For Bank Nifty traders also 200 day SMA or 49750 would be the key support zone. if it sustain above the same, then it could move up till 50900-51200. However, below 49750 or 200 day SMA the sentiment could change. Below which it could slip till 49300-49000. Short-term traders should remain cautious and be very selective as there is a risk to get trapped at lower levels.

Rupak De, Senior Technical Analyst, LKP Securities

On Thursday, Nifty closed near its 200-day EMA, forming a gravestone doji like pattern on the daily chart, signaling bearish sentiment. This suggests a “sell on rise” approach as the index hovers in an oversold zone near a key EMA level.

A bounce is likely, but it should be seen as an opportunity to sell. If Nifty breaks below the 200-day EMA, selling pressure could intensify. The index has support at 23,450, with resistance expected at 23,650, framing the short-term trading range.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The index is trading at a crucial support level. There can be a pullback as the hourly momentum indicator has triggered a positive crossover, however, the trend remains weak and pullback towards 23700 – 23750 should be used as a selling opportunity as the overall trend remains negative. On the downside we are expecting 23180 which coincides with the 61.82% fibonacci retracement level.

Bank Nifty also consolidated in a range after the sharp decline in the previous session. The consolidation is a brief pause in the overall downtrend. We expect the Bank Nifty to head south towards 49700 (200 DMA. On the upside, 50560 – 50700 shall act as an immediate hurdle zone from short term perspective.