Realme, one of the fastest-growing brands globally, is leading this push. The Shenzhen-based company has ambitious plans to more than double its market share in Europe over the next few years. It’s no small feat, but Realme has already seen a 275 per cent surge in European sales between 2020 and 2023, and the brand hopes to grow from 4 per cent to over 10 per cent market share in three to five years.

Over the past two years, Chinese smartphone brands faced significant challenges due to economic slowdowns, supply chain disruptions, and intense competition. The COVID-19 pandemic severely impacted consumer spending and production capabilities, leading to a sharp decline in smartphone sales. Brands like Xiaomi, OPPO, and Vivo had to deal with shrinking demand and logistical difficulties, which affected their market performance.

However, 2024 has seen a notable rebound as these companies are regaining momentum. Improved economic conditions, stabilised supply chains, and a resurgence in consumer spending have helped the market recover.

The push towards innovative designs and cutting-edge technology, such as foldable phones and enhanced 5G features, has also drawn consumers back. Aggressive marketing strategies and partnerships have further contributed to their recovery, allowing Chinese smartphone brands to regain market share both domestically and internationally, marking a solid comeback after years of struggle.A grand European strategy

Realme’s rise in Europe has been impressive, with the company becoming the fourth-largest smartphone supplier on the continent. It’s also hit global milestones, being the fastest brand to reach 100 million phone shipments in 2021 and 200 million in 2022. The brand’s Head of Product Marketing, Frances Wong, explained that success in Europe is crucial for Realme’s worldwide ambitions. But breaking through hasn’t been easy. Wong acknowledged the challenge of winning over fiercely loyal Apple and Samsung users and revealed that marketing costs in Europe are significantly higher than in markets like India.

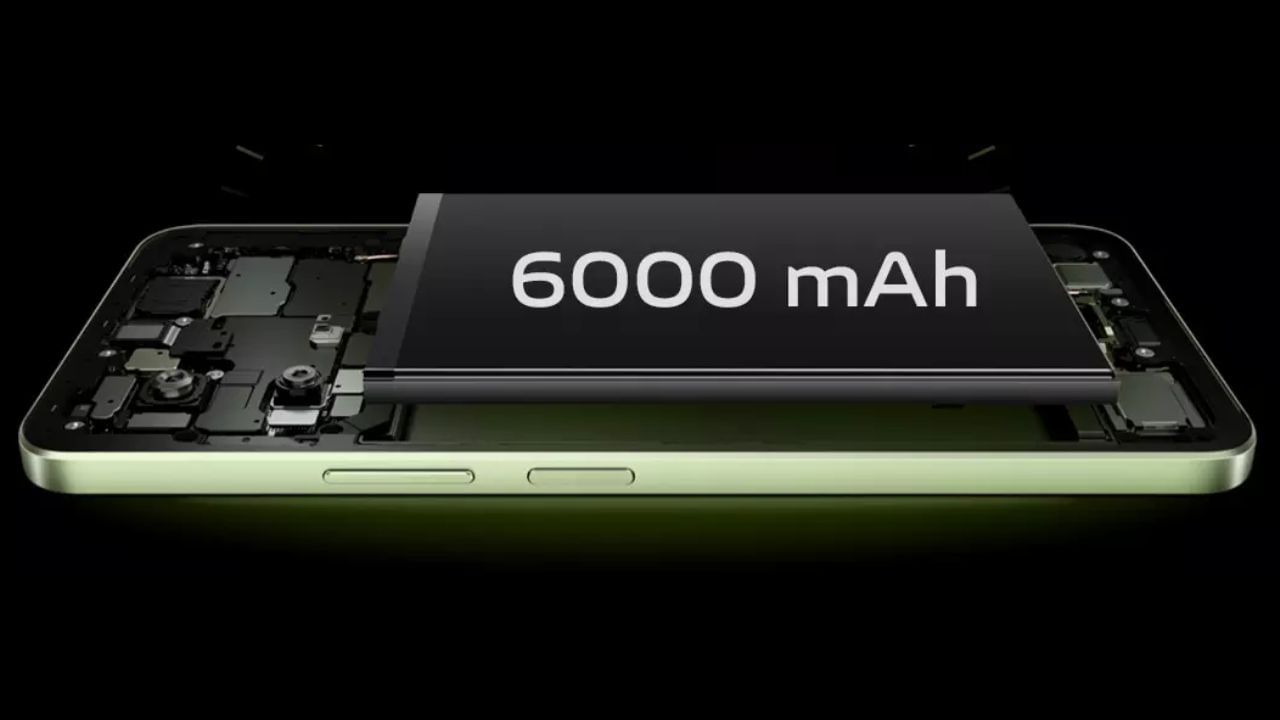

European consumers are less focused on value for money compared to other regions, which has made Realme’s growth slower in this market. However, the brand is banking on innovation to capture attention, investing in foldable phones, advanced cameras, and ultra-fast chargers to stand out from the crowd.Competition still fierce in the premium segment

Despite these efforts, Realme and other Chinese brands face an uphill battle in Europe’s premium smartphone market. Counterpoint data shows that Apple and Samsung continue to dominate, holding 94 per cent of the market for phones priced over $700. Huawei, once a serious contender in this space, saw its fortunes decline due to U.S. sanctions and restrictions on 5G technology, leaving a gap that brands like Realme and Honor hope to fill.

Honor has been making waves, recently overtaking Samsung to become the leading foldable phone seller in Western Europe. The company’s flagship Magic V3 foldable device, priced at €2,000, is positioned to compete directly with top-tier models like the iPhone 16 Pro Max. Honor’s President, Tony Ran, noted a growing openness among European consumers towards foldable technology, calling it a potential game-changer.The Battle for market share

Oppo, another big player, is making a bold return to Europe’s premium segment with its new Find X8 series. The company’s Overseas Marketing President, Billy Zhang, stressed Oppo’s commitment to the European market, despite ongoing challenges. Xiaomi, traditionally the third-largest smartphone vendor in Europe, has also been ramping up its efforts. The company increased its share of the premium market from 2.7 per cent in Q3 of last year to 4.3 per cent this year, according to IDC.

Meanwhile, smaller challengers like Transsion are finding success in Eastern Europe. Known for dominating the African market, Transsion has seen significant growth in mid-tier sales, adding more pressure to the competition. However, analysts warn that despite aggressive marketing campaigns – including sponsorships of high-profile events like the Champions League – Chinese brands have struggled to push their market share past 4 per cent.

Industry experts agree that European consumers remain tough to crack, but Chinese manufacturers are playing the long game. They argue that a strong presence in Europe could boost their credibility in other high-end markets like Japan, Australia, and even the US, potentially paving the way for future global success.