The Democrat’s NYC mayoral win has spooked investors, as his agenda is seen as a threat to profits from rent-regulated real estate.

- NYC REITs — ESRT, VNO, and SLG — fell amid investor anticipation of pressure on rental income and office demand.

- Flagstar Financial (FLG) also dipped amid concerns over its loan exposure to rent-stabilized properties.

- All three REIT stocks are in the red this year.

Democratic nominee Zohran Mamdani defeated former New York Gov. Andrew Cuomo, who ran as an independent, and Republican nominee Curtis Sliwa in the closely watched New York City mayoral election, securing over 50% of the vote.

Polls closed at 9 p.m. ET on Tuesday, with voter turnout reaching levels not seen in more than 50 years, according to media reports.

Throughout his campaign, Mamdani advocated for a rent freeze on rent-stabilized apartments, free public buses, and the creation of city-owned grocery stores. Those proposals have rattled investors in companies with exposure to New York City’s rent-regulated real estate market, where roughly 1 million apartments are rent-stabilized, CNBC reported.

A freeze on rent hikes could weigh on profits. Mamdani’s socialist-leaning platform could also lead to more selective corporate spending and potential outmigration from the city, dampening demand for office space, according to Mizuho’s Vikram Malhotra.

Analysts have identified at least four stocks that could see volatility following Mamdani’s victory. Here’s what we know about them following recent Q3 results:

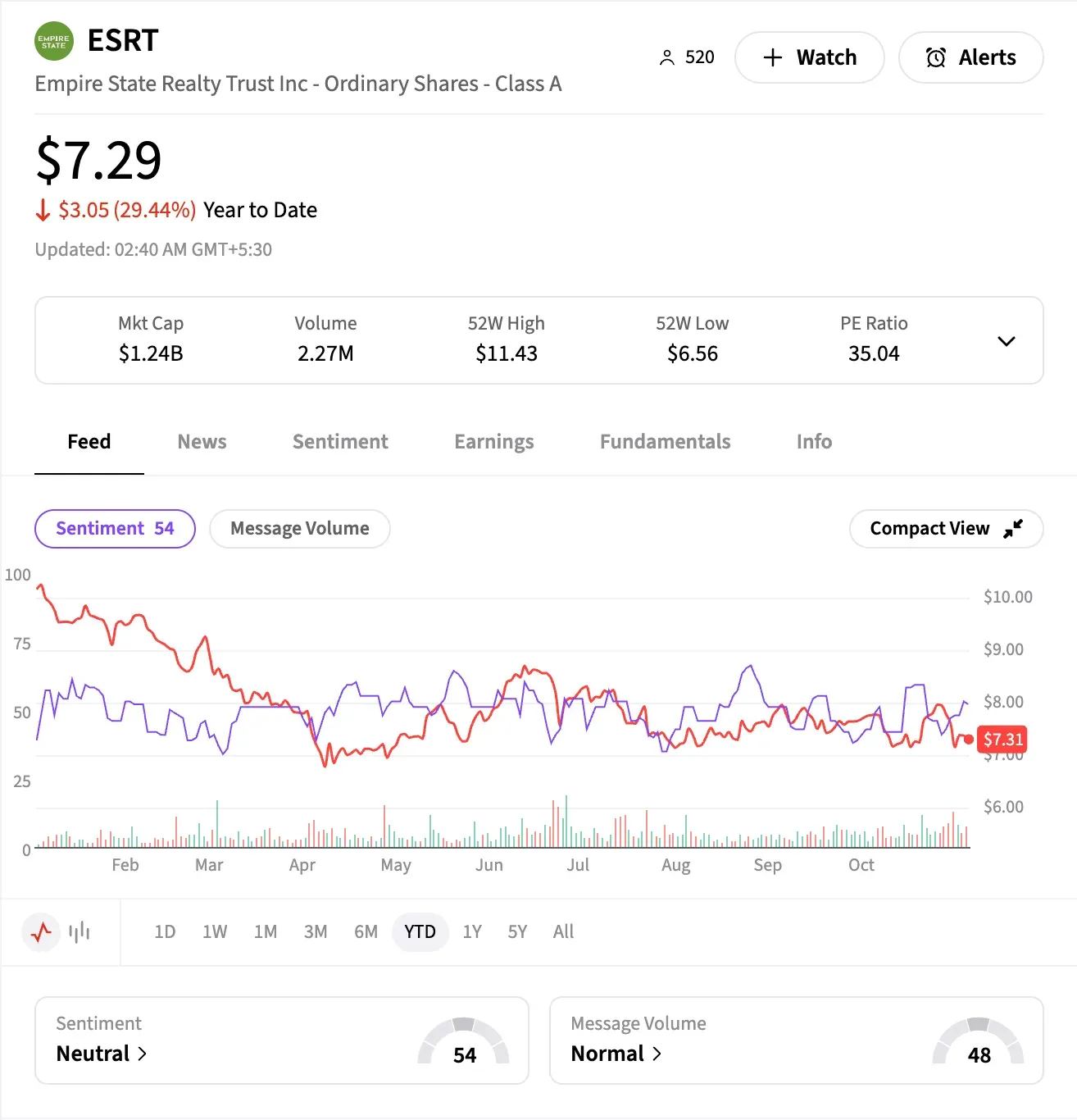

This New York-based REIT owns, manages, and repositions office and retail properties. Shares closed nearly 1% lower on Election Day and extended losses in after-hours trading.

Last week, the company reported Q3 funds from operations (FFO) of $0.23 per share, down from $0.25 a year earlier, while revenue slipped to $197.7 million from $199.6 million. However, Manhattan office occupancy rose 80 basis points sequentially to 90.3%, and total commercial occupancy reached 90.0%.

On Stocktwits, retail sentiment remained ‘neutral’, while message volume remained at normal levels.

According to Koyfin, short interest rose from 2.8% at the start of the year to 3.4% last week. Of seven Wall Street analysts, three rate it ‘Hold’, three rate it ‘Buy’/’Strong Buy’, and one rates it ‘Sell’.

ESRT stock is down nearly 30% year to date.

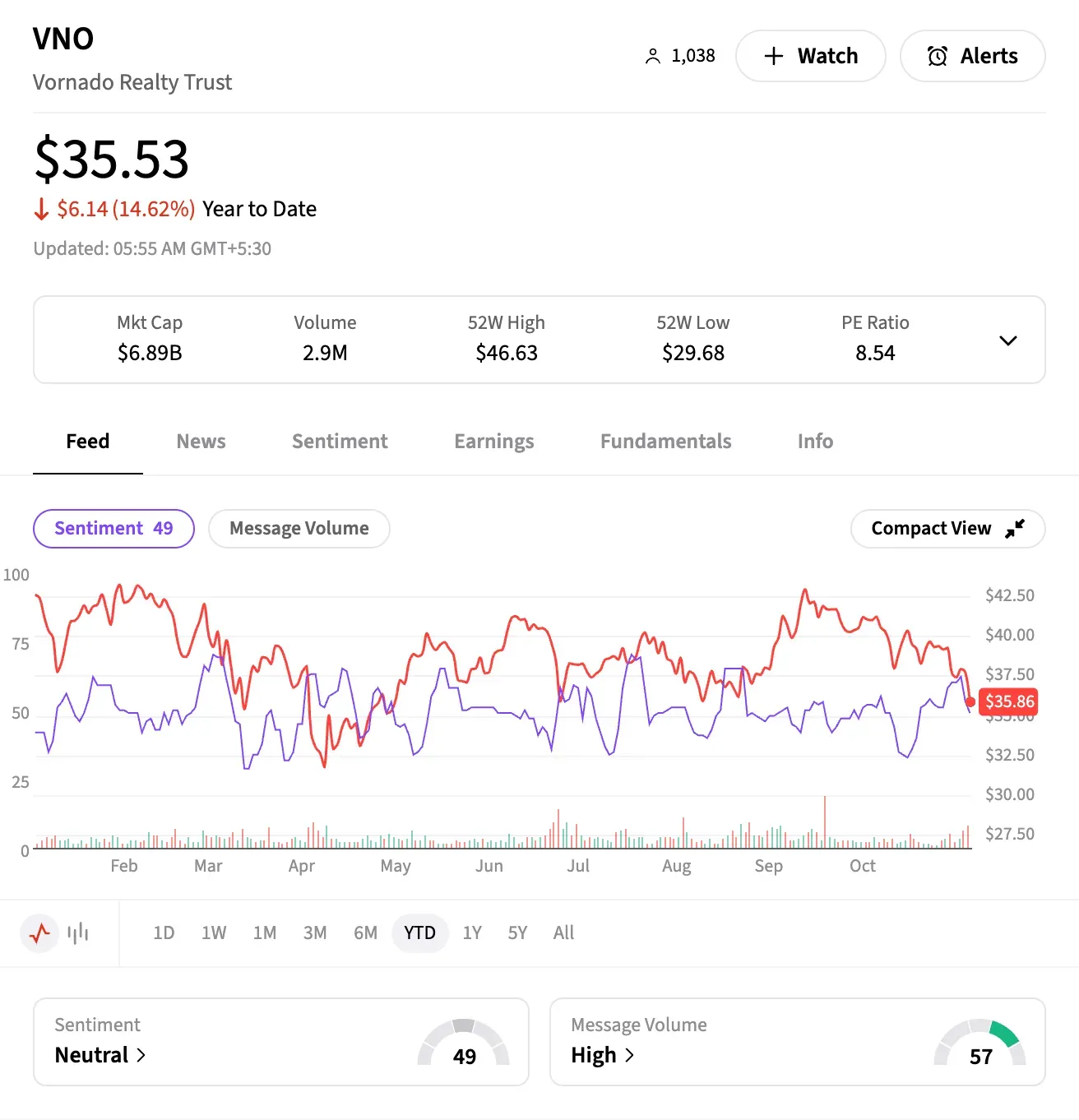

Another major NYC REIT, Vornado owns or manages nearly 20 million square feet of Manhattan office space and 2.4 million square feet of retail properties. Shares fell almost 5% on Election Day and continued to decline after hours.

On Monday, the company reported Q3 net income of $11.6 million, swinging from a loss in the prior year. FFO rose, helped by property sales, lease resets, and a master lease deal with NYU at 770 Broadway. Vornado also acquired 623 Fifth Avenue for $218 million, with redevelopment plans underway. The company did not issue forward guidance.

On Stocktwits, investor sentiment was ‘neutral’, while message volume tripled over the past month amid discussions of stock levels and the “Mamdani effect.”

Short interest declined from 7.3% to 3.7% since January. Of 15 analysts, eight rate it ‘Hold’, four ‘Buy’, and three ‘Sell’/’Strong Sell’.

VNO stock is down more than 14% this year.

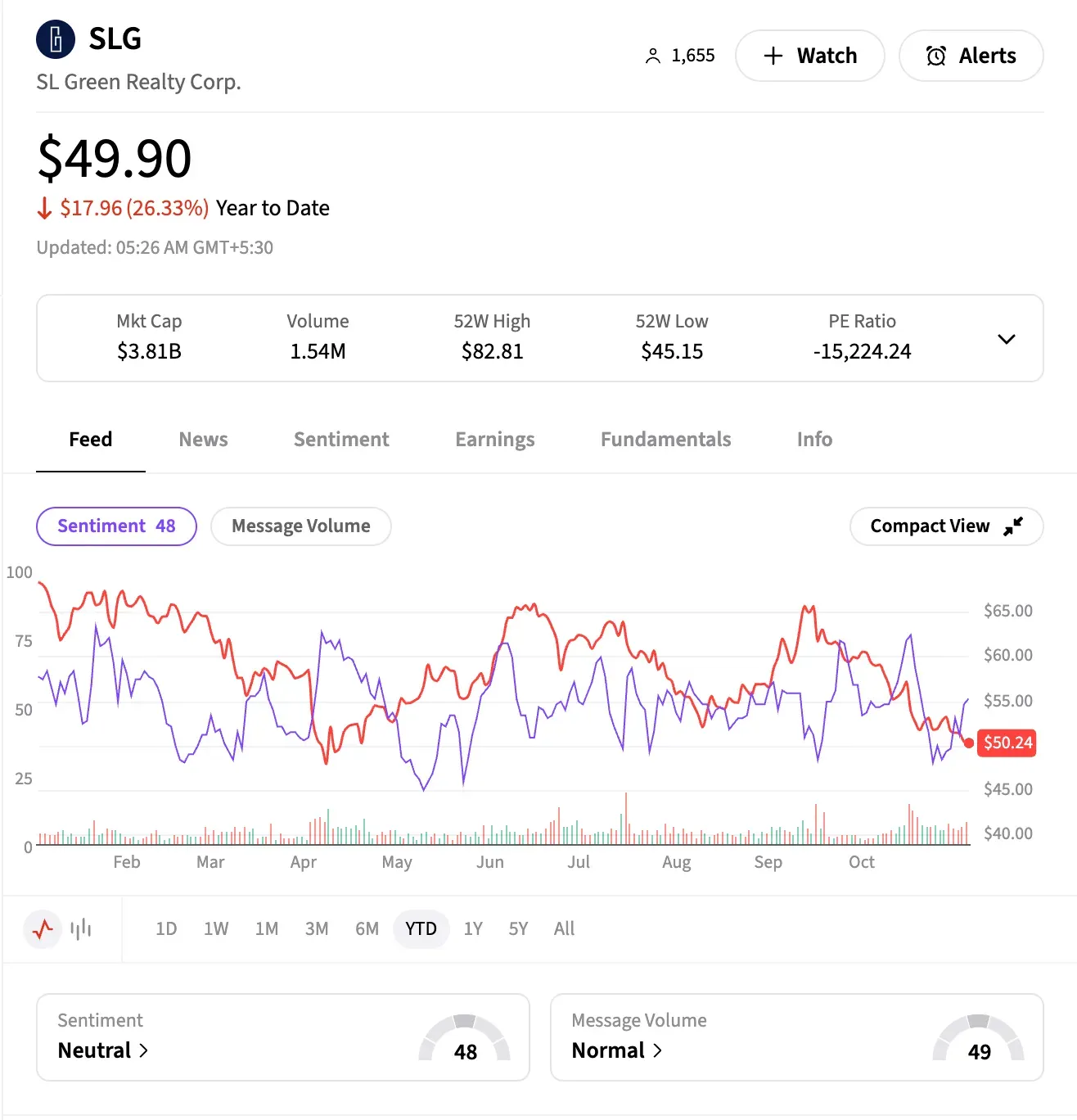

Calling itself “Manhattan’s largest office landlord,” SL Green owns interests in 53 buildings totaling 30.7 million square feet as of September. Shares dipped 0.3% on Election Day and another 0.6% in extended trading.

Last month, the company posted Q3 net income of $0.34 per share, beating estimates, while FFO climbed to $1.58 from $1.13 a year earlier. SLG signed 52 Manhattan office leases totaling 658,000 square feet and entered a $730 million deal to acquire Park Avenue Tower, expected to close in early 2026. It projects Manhattan office occupancy at 93.2% by year-end 2025.

Barclays analyst Brendan Lynch recently trimmed the firm’s price target to $59 from $60, maintaining an ‘Equal Weight’ rating.

On Stocktwits, sentiment was ‘neutral’, with the score slightly lower than at the start of the year, and message volume was ‘normal’.

Short interest dipped from 9.8% to 8.9%. Of 19 analysts, 11 rate it Hold, seven rate it ‘Buy’/’Strong Buy’, and one rates it ‘Sell’.

SLG stock is down over 26% this year.

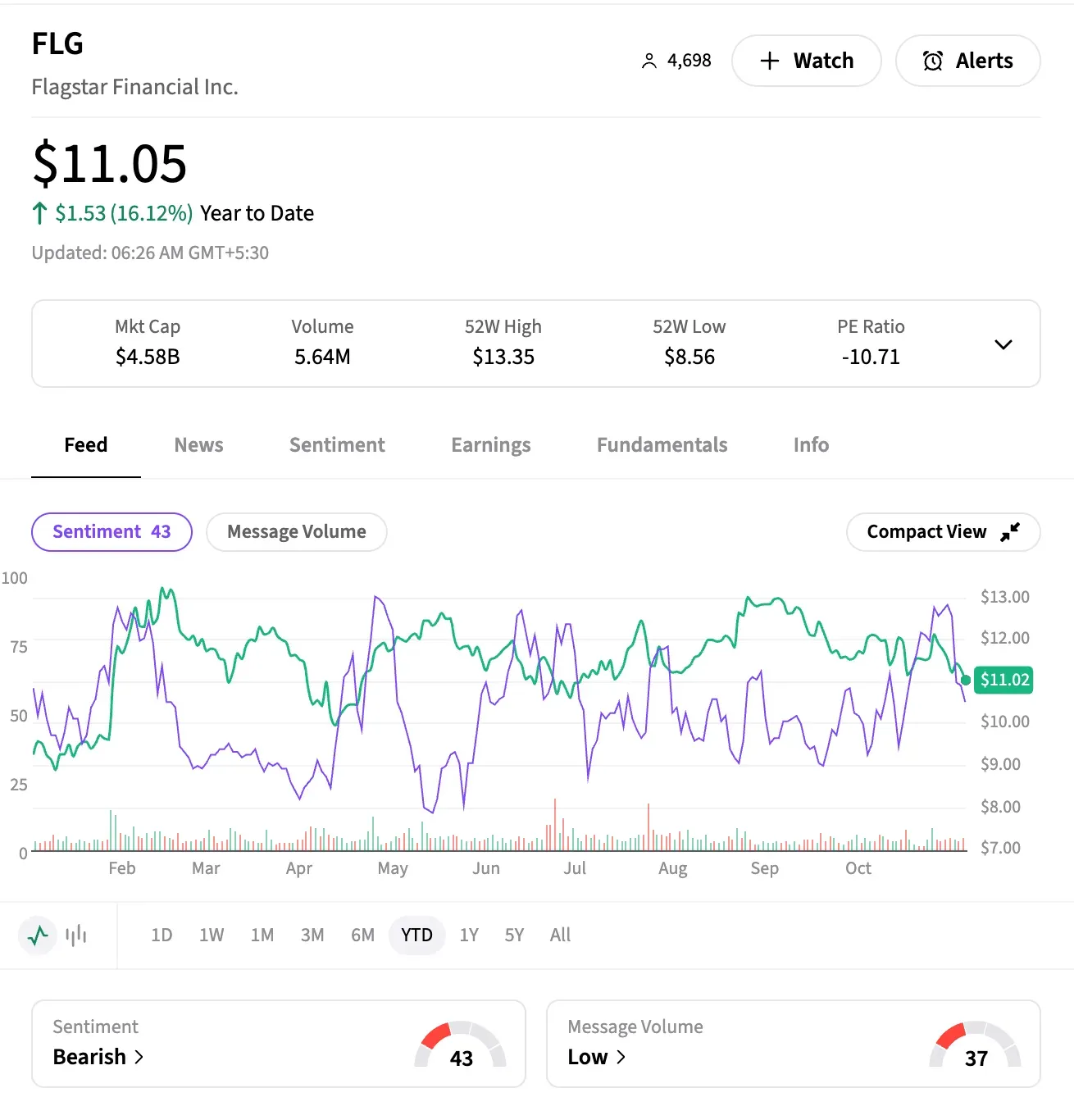

Unlike the others, Flagstar is a regional bank with significant exposure to loans tied to rent-stabilized units in New York. Following Mamdani’s primary win in June, those holdings drew a lot of attention, according to a Deutsche Bank note.

FLG shares closed 2.4% lower on Tuesday but edged higher in extended trading.

Last month, the company posted a slightly wider-than-expected Q3 loss per share, though revenue of $519 million topped forecasts. Tangible book value stood at $17.32, and its CET1 ratio at 12.45%. CEO Joseph Otting highlighted progress on strategic goals and balance sheet improvement.

Flagstar recently received approval from the Office of the Comptroller of the Currency to merge with Flagstar Bank, with the bank as the surviving entity.

On Stocktwits, investor sentiment has turned ‘bearish’ from ‘neutral’ six months ago, and message volume has remained subdued.

Short interest has held steady around 12% this year. Of 18 analysts, 11 rate it ‘Hold’ and seven ‘Buy’/’Strong Buy’.

FLG stock is up more than 16% year to date, outperforming the S&P 500.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<