Despite a decline in key Q3 metrics and a cautious commentary on outlook, the company raised its full-year 2025 estimates.

- Operating income sank to $259 million from $1.24 billion last year.

- ZIM attributed the drop to lower freight rates and softer volumes.

- Both Q3 revenue and EPS beat analyst estimates, according to Stocktwits data.

Shares of ZIM Integrated Shipping Services (ZIM) climbed 2% on Thursday, despite the company posting a weak third-quarter print. The stock reversed its premarket losses after declining around 4.5%.

Q3 Results

The company’s total revenue declined 36% to $1.78 billion, while net income plunged to $123 million, from $1.13 billion in the same period last year. However, it marginally beat Stocktwits’ estimate of $1.77 billion. ZIM attributed the drop to lower freight rates and softer volumes.

While its diluted earnings per share (EPS) sank to $1.024 from $9.34, it came well above estimates of $0.77.

Operating income fell to $259 million from $1.24 billion last year, while adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margins contracted to 33%, compared with 55%. ZIM’s board declared a dividend of $0.31 per share.

The primary pressure came from pricing, with the average freight rate dropping to $1,602 per twenty-foot equivalent unit (TEU), compared to $2,480 TEU in the previous corresponding period. A TEU is a general unit to measure cargo capacity.

“Our approach to renewing charter this year signal a cautious outlook, particularly as the market fundamental still point to supply growth, outpacing demand moving forward. As such, we anticipate continued pressure on freight rates during the remainder of the fourth quarter and into 2026,” said CEO Eli Glickman in a conference call with analysts, according to Koyfin.

“The outlook for container shipping remains cautious as growth in supply is expected to outpace the growth in demand in the foreseeable future,” said CFO Xavier Destriau during the same call.

Despite a decline in key Q3 metrics and a cautious commentary on outlook, the company remained bullish about its prospects, slightly raising its full-year 2025 estimates. It now expects adjusted EBITDA of $2 billion to $2.2 billion and adjusted EBIT of $700 million to $900 million.

How Did Stocktwits Users React?

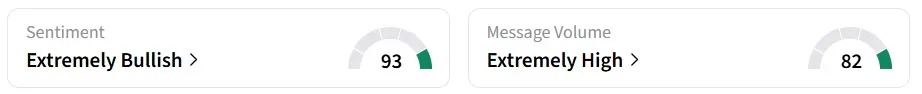

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory for the past 24 hours, accompanied by ‘extremely high’ message volumes. At the time of writing, ZIM was among the top trending tickers on the platform.

One user expects the stock to climb to $20.

However, another user expects a decline due to challenging shipping rates.

The stock witnessed an uptrend over the past few sessions, gaining in seven consecutive sessions until Monday’s close. Year-to-date, ZIM has shed nearly a fourth of its value.

Read also: Dollar Index Steadies Above 200-DMA After Crossing The Mark For First Time Since March 2025

For updates and corrections, email newsroom[at]stocktwits[dot]com.<