Investor interest in new-age tech stocks remained volatile this week despite gains in the broader market. Meanwhile, two new new-age tech companies made their public market debut during the week.

While Capillary Technologies’ yesterday, they ended the trading session 8.38% higher from the listing price at INR 606.9. Edtech major on November 17 (Monday), listing at a 33% premium to the issue price. However, the stock declined 5.77% from INR 143.1 to close the week at INR 134.85 amid profit booking.

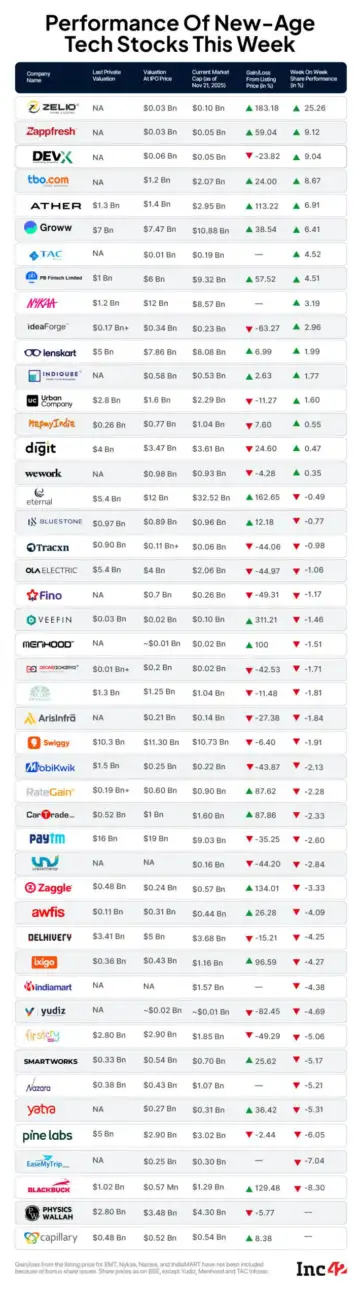

Overall, shares of 29 out of the 45 new-age tech companies under Inc42’s purview declined 0.49% to over 8% this week. In this, logistics major Blackbuck fell the highest at 8.3% to end the week at INR 640.35. The list of losers also included Paytm, IndiaMART, Delhivery, DroneAcharya and BlueStone.

Meanwhile, shares of 16 new-age tech companies gained in a range of 0.35% to over 25%.

BSE SME-listed E2W company Zelio E-Mobility was the biggest gainer of the week, with its shares zooming 25.3% to end at INR 438.65. The company’s shares touched an all-time high of INR 446.85 on November 20 (Thursday).

Other companies that touched fresh highs this week were Zappfresh, Nykaa, CarTrade and Yatra. TBO Tek, Groww, PB Fintech, ideaForge, Lenskart, among others, also rallied this week. However, shares of EaseMyTip, Awfis and DevX hit fresh 52-week lows in the past week.

With the inclusion of PhysicsWallah and Capillary, the total market cap of 47 new-age tech companies under Inc42’s coverage stood at $131.52 Bn at the end of the week. Excluding the two new additions, the cumulative market cap of 45 of these companies fell to $126.68 Bn from $127.42 Bn last week.

With that, here’s a look at some of the key developments from the Indian new-age tech companies this week:

- Elevation Capital via two block deals on November 18 (Tuesday), reducing its shareholding in the fintech major to 8.59 Cr shares. The company’s shares declined 2.6% to end the week at INR 1,265.90.

- RateGain CEO Bhanu Chopra increased his stake in the company to 37.79% by acquiring 1.43 Lakh equity shares via open market transactions. The stock declined 2.28% to end the week at INR 684.45.

- Digital-first Fino Payments Bank paid GST authorities INR 10.2 Cr with respect to input tax credit claimed by it. The company said it paid the amount under protest and will contest the move. Its shares declined 1.17% to end yesterday’s trading session at INR 277.80 on the BSE.

- FirstCry’s roll up subsidiary Globalbees acquired an additional 20% stake in DF Pharmacy, a pharma company which sells skincare products Kozicare, Glutalight, among others, for INR 21.6 Cr. It now holds an 80% stake in the subsidiary. The company’s shares plunged 5.06% this week to INR 316.95.

- Brokerage Jefferies initiated its coverage on and a price target of INR 790. The company’s shares gained 0.35% this week to end at INR 618.85.

With this, let’s recap what happened in the broader market.

Momentum Continues In Broader Market

After breaking its losing streak last week, the Indian equities market continued to rally this week. While Sensex gained 0.8% to end at 85,231.92, Nifty 50 gained 0.7% to end at 26,068.15. Both the indices are hovering close to their all-time highs as of now.

Bullish sentiment swept through Indian equities this week as macro stability, steady domestic inflows and stronger-than-expected Q2 earnings lifted investor confidence. Global brokerages highlighted India as a relative safe haven amid global jitters, pushing benchmark indices higher and triggering fresh interest in large cap financials and technology companies.

Brokerages like Goldman Sachs and HSBC have shifted to a more bullish stance on Indian equities, citing a turnaround driven by domestic equity purchases and improving earnings. Besides the strong Q2 earnings show, Geojit’s research head Vinod Nair attributed the bullish sentiment to easing inflation and optimism around India-US trade negotiations.

However, markets turned volatile yesterday amid weak global cues and rising concerns over potential delays in the India-US trade talks. While volatility hasn’t fully ebbed, the broader setup suggests room for a valuation rerating as India’s growth narrative regains momentum.

“The market may witness some profit booking in the near term if the pressure on Indian rupee persists. In the week ahead, investors will also keep a close vigil on trade developments and economic data like IIP and Q2 FY26 GDP data,” Nair said.

Now, let’s take a detailed look at the performance of a couple of new-age tech stocks this week.

BlackBuck Cofounders Offload Shares

Logistics major BlackBuck ended the week as one of the biggest losers after its three cofounders collectively through multiple block deals on Tuesday. The trio offloaded 36 Lakh shares together at INR 676.6 apiece.

CEO Rajesh Yabaji sold 20 Lakh shares for INR 135.3 Cr, while COO Chanakya Hridaya and executive director Ramasubramanian Balasubramaniam sold 8 Lakh shares each, pocketing INR 54.11 Cr apiece.

Post the sale, Yabaji’s stake in the company fell to 10.7% from 11.81% and Hridaya’s reduced to 7.45% from 7.89%. Balasubramaniam’s stake declined to 6.98% from 7.42%. The shares sold by the trio were picked up by Discovery Global Opportunity Mauritius, TIMF Holdings, Motilal Oswal Financial Services, 360 ONE Asset Management, Citigroup and Goldman Sachs.

Earlier, Goldman Sachs offloaded a part of its holding in BlackBuck, selling 49.1 Lakh shares worth INR 294.7 Cr in September. Prior to that, Sands Capital sold shares worth INR 135.6 Cr across two block deals in August, while Wellington Management dumped shares worth INR 53.7 Cr stock.

The latest share sale came on the back of a sharp rally in BlackBuck’s shares, which have surged more than 19% over the past three months and nearly 43% year to date. The rally has been driven by the company’s strong performance in Q2 FY26 – BlackBuck posted a c versus a loss of INR 308.4 Cr in the year-ago quarter, while operating revenue jumped 53% YoY to INR 151.1 Cr.

Groww’s First Week As Listed Company

Groww began the week on a firm note, extending its post-listing momentum, seeing steady buying interest. However, the tone shifted mid-week. Groww slipped into the red on Wednesday and Thursday as profit booking kicked in at higher levels.

Analysts pointed to stretched valuations and muted cues from global markets, which dragged fintech counters and briefly halted Groww’s rally.

Despite the back-to-back declines, the stock managed to hold above key support levels, signalling that long-term conviction remains intact. The company’s shares ended the week up 6.41% at INR 157.93.

Groww declared its financial performance for the September quarter during the early trading hours yesterday. Its and grew nearly 25% QoQ as active users rose. However, operating revenue fell 9.5% YoY due to true-to-label norms and derivatives regulations but improved 12% sequentially.

The company continues to invest to bolster its margin trading facility and loan against securities businesses.

Besides, it also completed the acquisition of Fisdom in October, and accounted for INR 961 Cr for the acquisition in Q2.

Groww’s shares ended the week 6.41% higher at INR 157.93 on the BSE.