Xpeng’s five-year American journey has been marked by soaring IPO highs, sharp corrections, and steady delivery growth that’s kept it in the race with Nio and Li Auto, even as Tesla’s scale continues to tower over the sector.

Five years ago, on Aug. 27, 2020, Xpeng stepped onto the floor of the New York Stock Exchange with all the buzz of a rising star in the electric-vehicle boom. Backed by Alibaba’s deep pockets, the young automaker pulled in $1.5 billion and saw its shares rocket 40% on the very first day.

The enthusiasm only grew in the months that followed, with Xpeng’s stock climbing to $72.17 within three months, more than tripling from its IPO price.

The early euphoria didn’t last. By August 2025, Xpeng’s stock hovered around $24 — a rebound from the start of the year, but still more than 70% below its peak.

Deliveries: Building Momentum Step By Step

Xpeng’s deliveries have shown a more pronounced upward trend.

In 2020, Xpeng was barely a blip on China’s auto map, selling just over 27,000 cars. By the following year, it had found its footing, nearly quadrupling sales to close to 100,000. Then the race for dominance intensified. Rivals Nio and Li Auto began pulling away, and through 2022 and 2023, Xpeng found itself slipping behind in the pack.

The comeback came in 2024. Deliveries jumped 34% to 190,000, and the company carried that momentum into this year. Month after month, from November 2024 through July 2025, Xpeng has consistently cleared the 30,000 mark, reaching a record high of 36,717 in July.

In the first half of this year alone, it sold nearly 200,000 cars, which is already more than the entirety of 2024. The company is now looking to double annual deliveries to roughly 380,000, putting it within reach of Nio’s 440,000 target.

But the scale of Tesla still looms large. The U.S. giant delivered 1.8 million cars in 2023, 1.79 million in 2024, and another 1.68 million so far this year, highlighting volumes that underscore just how far Chinese contenders still have to catch up.

Revenue: From Hundreds Of Millions To Billions

Xpeng’s revenue has grown from under $900 million in 2020 to $5.6 billion in 2024, with Deutsche Bank projecting $8.4 billion this year.

The most recent quarter reported record sales of 18.27 billion yuan ($2.55 billion) and improved margins of 17.3%, largely driven by the Mona M03 sedan, which now accounts for roughly half of monthly sales.

Tesla’s financials tell a similar story on a far larger scale. The U.S. automaker generated $31.5 billion in revenue in 2020 and nearly tripled that to $97.7 billion by 2024, with sales already hitting $92.7 billion this year.

How Rivals Have Fared

Nio delivered 221,970 vehicles in 2024, bringing in $9 billion in revenue. Li Auto has surged even faster, handing over 500,508 cars last year and generating nearly $20 billion in sales.

Both have consistently outpaced Xpeng in sheer volume.

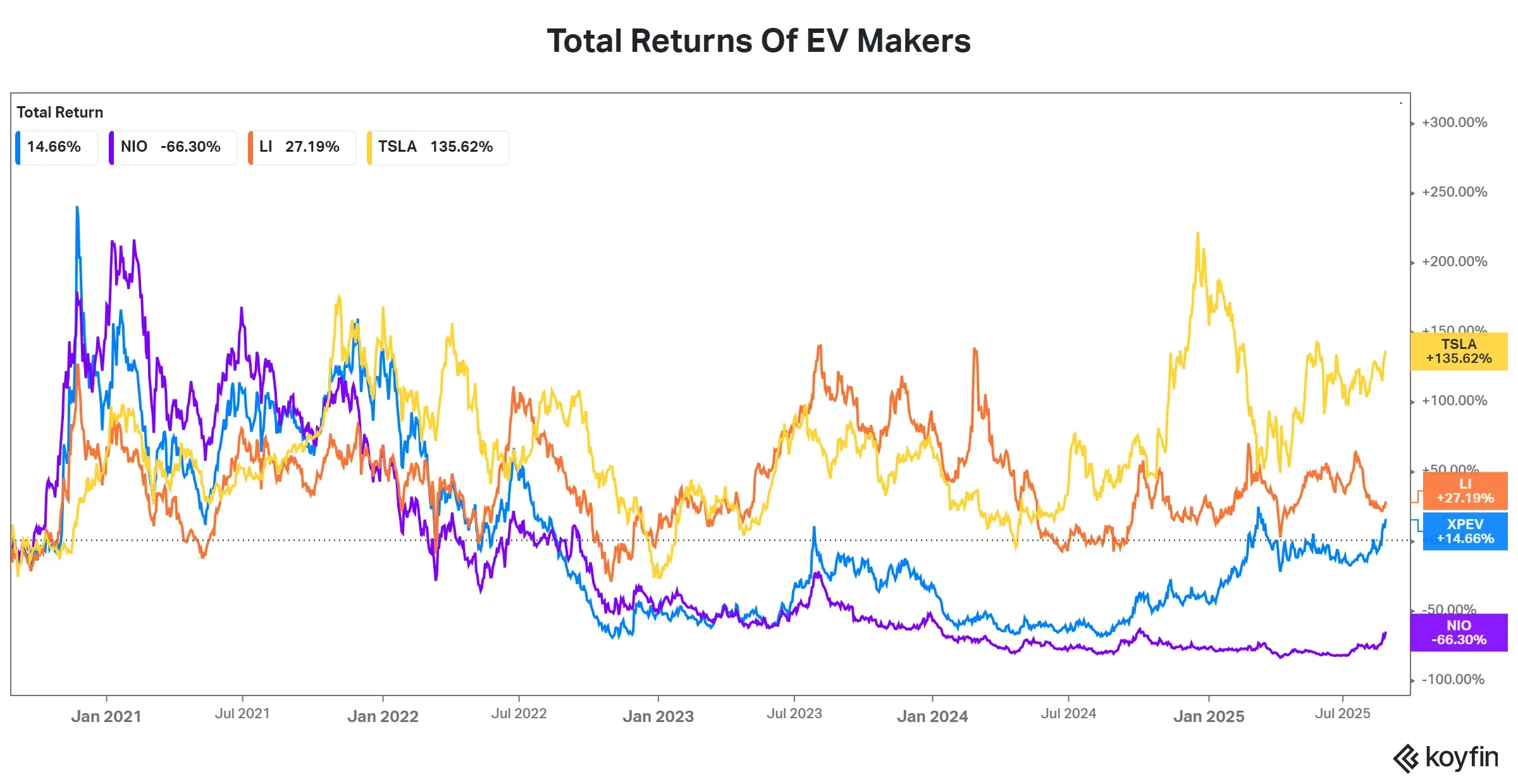

Stock Returns: A Mixed Bag

For investors, the past five years have been uneven. Since its IPO, Xpeng shares are up 14.7%. Li Auto has done better, with gains of 27.2%. Nio, once the darling of the Chinese EV boom, is down 66.3% from its 2020 levels.

Tesla, meanwhile, has delivered the strongest long-term return, with shares up 135.6% over the same period.

On Stocktwits, retail sentiment around Chinese EV makers was upbeat, with Nio seen as ‘extremely bullish’ amid ‘extremely high’ message volume, while Xpeng was ‘bullish’ with ‘extremely high’ activity and Li Auto also ‘bullish’ on ‘high’ engagement.

Tesla, meanwhile, drew ‘bullish’ sentiment on ‘normal’ volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<