The EV maker confirmed its first hybrid model, the X9 MPV EREV, which is set to debut in Q4, boosting investor optimism.

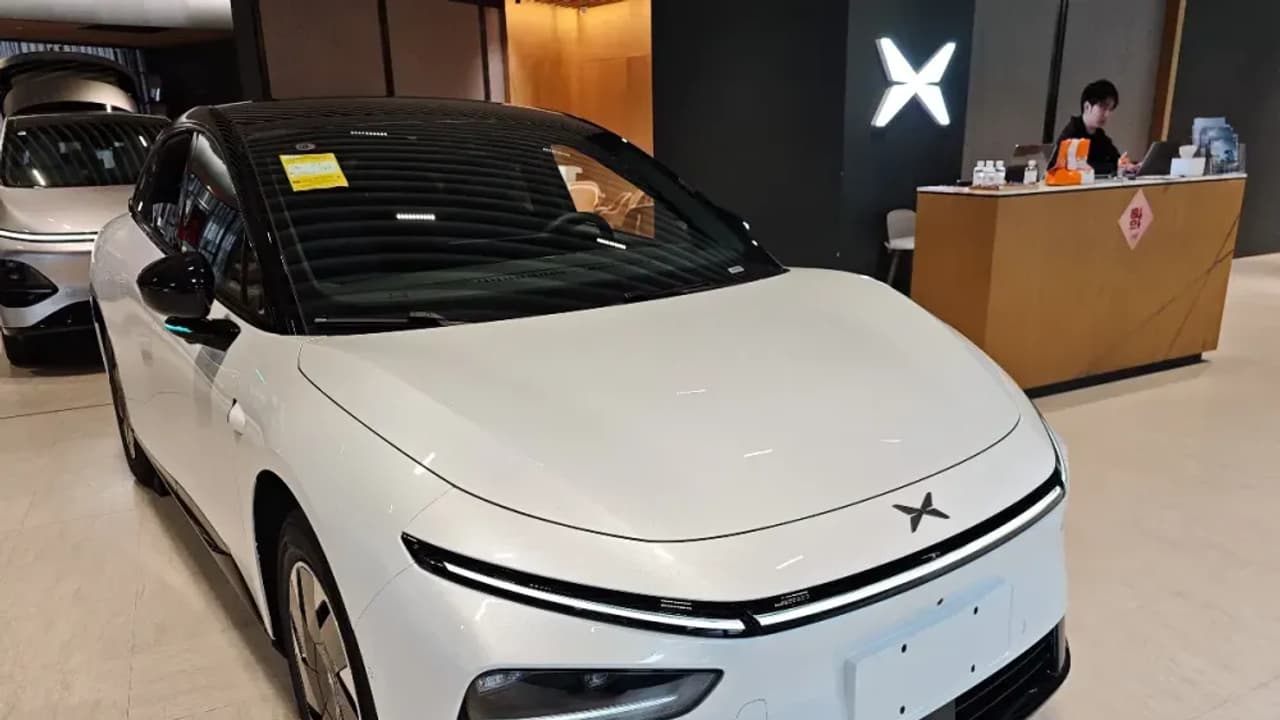

Xpeng shares jumped in Hong Kong on Monday after the EV maker confirmed its first hybrid model, the X9 MPV extended-range electric vehicle (EREV), will launch in the fourth quarter.

The stock rose 7.94% to HK$85.65 on Monday, hitting a five-month high.

The X9 EREV appeared in China’s Ministry of Industry and Information Technology filing catalog last week, according to a CnEVPost report.

Chairman and CEO He Xiaopeng said on Weibo that Xpeng has deployed over 1,000 test vehicles for more than 800 days across 20 countries and 330 cities, describing it as a “global” product.

The model is slightly longer than the all-electric X9, adding a 1.5-liter Harbin Dongan engine as a range extender, and is intended as a reliable 7-seat family car. A “450” marking on the body suggests a 450-kilometer battery range.

The current all-electric X9 is priced at 359,800 yuan–419,800 yuan ($50,090–$58,460) with a CLTC range of 650–740 km and has delivered 12,698 units between January and July, accounting for 5.43% of Xpeng’s total deliveries of 233,906 units.

The EREV will feature Xpeng’s Kunpeng Super Electric System, unveiled in November 2024, offering a combined range of up to 1,400 km and a battery range of 430 km, which the company claims is the longest in the industry.

XPeng reported that it delivered 36,717 vehicles last month, marking a whopping 229% increase from the same period in the previous year.

Last month, Xpeng Aeroht, the company’s flying car division, secured $250 million in Series B funding to accelerate mass production of its modular Land Aircraft Carrier.

The Guangzhou factory, expected to be completed in Q4, will have an annual capacity of 10,000 units, with deliveries targeted for 2026 at a cost of under 2 million yuan ($279,050). Aeroht has also named former Deutsche Bank executive Du Chao as its first CFO to drive IPO plans in Hong Kong or the U.S.

On Stocktwits, retail sentiment for Xpeng was ‘extremely bullish’ amid ‘normal’ message volume.

Xpeng’s Hong Kong-listed shares have gained 87.8% so far in 2025, while its U.S.-listed stock is up 74.9% over the same period.

($1=7.18 yuan)

For updates and corrections, email newsroom[at]stocktwits[dot]com.<