Xiaomi’s EV business accelerated with record deliveries and its first operating profit.

- Xiaomi’s EV business accelerated with record deliveries and its first operating profit.

- The company warned smartphone prices will rise next year due to surging memory-chip costs.

- EV, AI and new-initiative revenue grew sharply, now making up a quarter of total sales.

Xiaomi’s U.S.-listed shares suffered their sharpest single-day decline in almost seven months after the company warned that smartphone prices will rise next year due to soaring memory-chip costs. The selloff overshadowed a quarter in which Xiaomi’s fast-scaling electric-vehicle business continued to deliver blockbuster growth and its first sustained profitability.

The company’s U.S.-listed stock closed down 7.4% on Wednesday and its Hong Kong-listed stock fell 3.6% in late Asian trade on Thursday.

EV Division Emerges As Xiaomi’s Bright Spot

Despite the market reaction, Xiaomi’s EV division remains the strongest part of the company’s growth story. The company now expects to deliver more than 400,000 cars this year, racing past its earlier 350,000-unit target “by this week.” It also marked Xiaomi’s 500,000th vehicle rolling off the production line on Thursday, marking a milestone just 19 months after the company’s first EV sale, according to a Bloomberg report.

Xiaomi’s EV, AI and “new initiatives” segment accounted for 25% of total revenue in the third quarter (Q2). EV revenue climbed to 28.3 billion yuan, up from 20.6 billion yuan in the second quarter (Q2) and 18.1 billion yuan in the first quarter (Q1). The division also turned its first operating profit of 700 million yuan, making Xiaomi one of the fastest companies to achieve EV profitability at scale.

Quarterly EV deliveries reached 108,796, boosted by the new YU7 electric SUV launch. Xiaomi will accelerate production, reduce wait times and increase R&D spending, especially on more advanced AI-driven driver-assistance features.

Smartphone Price Warning Sparks the Selloff

The decline in Xiaomi’s shares came shortly after President Lu Weibing warned that memory chip inflation would push smartphone prices higher in 2025. He said pressure from chip costs would be “much heavier” next year, adding that “price increases alone won’t be enough” to offset rising component expenses, Reuters noted.

Global memory-chip makers have shifted capacity toward high-bandwidth memory for AI servers, tightening supply for chips used in smartphones. The warning followed earlier consumer criticism of Xiaomi’s new Redmi K90 model’s pricing.

Xiaomi shipped 43.3 million smartphones during the quarter, up 0.5% year-on-year, holding on to third place globally with a 13.6% market share. Quarterly revenue rose 22.3% to 113.1 billion yuan, but came in below analyst expectations.

Stocktwits Users See ‘Buy’ Opportunity

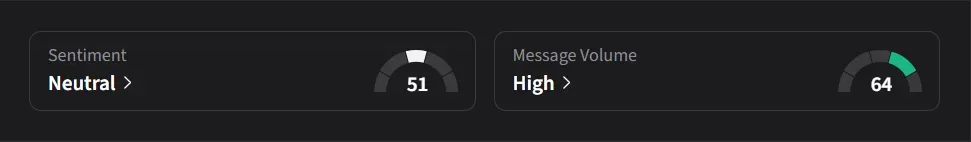

On Stocktwits, retail sentiment for Xiaomi was ‘neutral’ amid ‘high’ message volume.

One user called the decline an “amazing buy opportunity.”

Another user pushed back, saying bears had warned of shrinking margins, fierce competition, and long wait times, but noted that premium phones are climbing, EVs are scaling fast, and margins are at record highs, adding that Xiaomi is “winning.”

Xiaomi’s U.S.-listed stock has declined 7.4% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<