IT major Wipro will announce its December quarter earnings on Friday, January 16. The company is likely to report low single-digit growth in revenue and net profit.

According to experts, Wipro’s Q2 revenue could remain in the range of ₹23,410 to ₹23,450 crore, up 4 to 5% YoY. Sequentially, revenue could rise by 3 to 4%. The company registered revenues of ₹22,319 crore in Q3FY25 and ₹22,697 crore in the previous quarter.

Meanwhile, its consolidated net profit could increase by 1 to 1.5% YoY to ₹3,350 to ₹3,385 crore and 3 to 4% rise sequentially. Wipro reported a net profit of ₹3,246 crore in the previous quarter and ₹3,354 crore in Q3FY25. Wipro’s EBIT margin is expected to remain muted in the range of 16.3% to 16.7% during the quarter.

During the result announcement, investors will closely track Wipro’s revenue growth guidance for upcoming quarters, the number of new deal wins and management’s commentary on business outlook on US and European business.

Ahead of the Q3 result announcement, Wipro shares ended the day 1.5% lower at ₹260 per share on January 14. Wipro shares are down -10.8% in the last one year.

Technical view

The technical setup of Wipro remains in a short-term corrective phase. The stock has reclaimed both the 50-day exponential moving average (EMA) and the 200-day EMA and will act as a crucial support zone. As long as Wipro remains above ₹255-257zone, the medium-term outlook is positive. However, a decisive breakdown below ₹255 could allow for a deeper retracement. Overall, the structure suggests consolidation with a mildly bullish bias, unless key supports are breached.

Options outlook

The options data for 27 January expiry shows significant call options base at 265 and 270 strikes, indicating resistance for the stock around these zones. Meanwhile, the put was observed at 260 and 250 strikes, hinting at support around these zones.

Wipro’s at-the-money (ATM) strike is at 260, and the combined premium of the call and put options is ₹12.6. This suggests that, ahead of the 27 January expiry date, the options market anticipates a potential movement of ±4.9%.

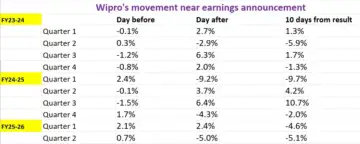

Let’s examine how Wipro stock has reacted to its quarterly earnings announcements over the past two years.

Options strategy and approach

Given the implied move of ±4.9% from the options data, traders can initiate either a long or short volatility strategy. To trade based on volatility, a trader can take a Long or Short Straddle route.

Straddles are the options strategies that are primarily used on the basis of volatility. In simple terms, in a Long Straddle, a trader can buy an ATM call and a put option of the same strike and expiry of Wipro, looking for a move of more than ±4.9% on either side.

On the other hand, the Short Straddle capitalises on the fall in volatility. In a Short Straddle, a trader sells both an ATM call and a put option of the same strike and expiry. This strategy is deployed when the trader believes that the price of Wipro after the earnings announcement will be in a range of ±4.9%.