The Central government has proposed two tax rates of 5% and 18% in the revamped goods and services tax (GST), slated to replace the current indirect tax regime by Diwali this year, according to media reports.

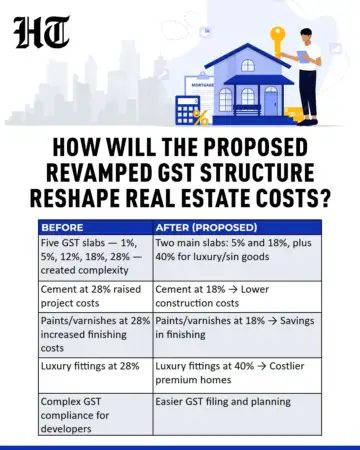

While the presently nil or zero per cent GST tax is charged on essential food items, 5% is charged on daily use items, 12% on standard goods, 18% on electronics and services, and 28% on luxury and sin goods, the revamped GST regime will have two slabs plus a special rate of 40% for luxury and ‘sin’ goods.

The development comes hours after Prime Minister Narendra Modi, during the Independence Day address, promised next generation Goods and Services Tax (GST) reforms as a Diwali gift for the country.

In real estate, construction materials attract varying GST rates, cement at 28%, steel at 18%, paint and varnishes at 28%, ceramic tiles at 18%, and sanitary ware at 18%. Services like architectural design and project management are taxed at 18%. These rates directly influence project costs and, in turn, housing prices.

Under-construction residential property attracts 5% GST (1% for affordable housing), while ready-to-move-in property with an occupancy certificate attracts no GST.

Also, under the proposed GST structure, most goods and services would fall under either the 5% or 18% slab, replacing the current 5%, 12%, 18%, and 28% rates. However, even if the government cuts indirect taxes, the key question remains: will developers pass on the savings to homebuyers, or retain them to protect profit margins, say experts.

“A reduction in GST on under-construction homes would provide much-needed relief, making housing more affordable and boosting sentiment in the real estate sector,” says Vikas Bhasin, MD of Saya Group, a luxury real estate developer.

Agrees Pradeep Aggarwal, founder and chairman, Signature Global (India), “The housing sector stands to benefit from these reforms, as moving to a two-slab structure will not only make GST compliance easier for real estate developers, but also help rationalise input costs, improve cash flows and eventually reduce the cost of homes for buyers.”

Lower input costs may boost affordability

Currently GST in the real estate sector applies through multiple rates.

Affordable housing projects attract a GST of 1% without input tax credit. On the other hand, non-affordable housing attracts a GST of 5%. Affordable housing is officially defined as a residential unit up to 60 sq. m carpet area in metropolitan cities and 90 sq. m in non-metros) and priced up to ₹45 lakh.

Let us take the case of cement which is a key input. If GST on cement reduces from 28% to 18%, developers will see a significant reduction on construction costs.

“Even if the government reduces indirect taxes, the real question is whether developers will pass on the benefit to homebuyers. There’s a possibility they may retain it to safeguard their margins, rather than lowering prices,” says Abhishek Kumar, founder and chief investment advisor of SahajMoney, a financial planning firm.

“Even if the government reduces indirect taxes, the real question is whether developers will pass on the benefit to homebuyers. There’s a possibility they may retain it to safeguard their margins, rather than lowering prices,” says Abhishek Kumar, founder and chief investment advisor of SahajMoney, a financial planning firm.

Affordable housing rates are likely to change substantially, if the concessional tax treatment continues. However, luxury housing can see higher indirect costs if high-end fittings and finishes fall under the 40% luxury rate, say experts..

Push towards formalisation of property deals

Experts believe that revision of GST rates could do more than trim costs. It has the potential to bring a structural shift in the way real estate transactions are conducted. With the lowering of the overall tax burden, the sector could witness higher compliance, reduced cash dealings and a greater flow of transactions through formal channels.

“A 10%-20% reduction in overall taxation would make property more affordable, spur transactions, and shift dealings into the formal economy, a major boost for India’s largely cash-oriented real estate sector,” says B. Srinivasan, director and founder, Shree Sidvin Investment Advisors.