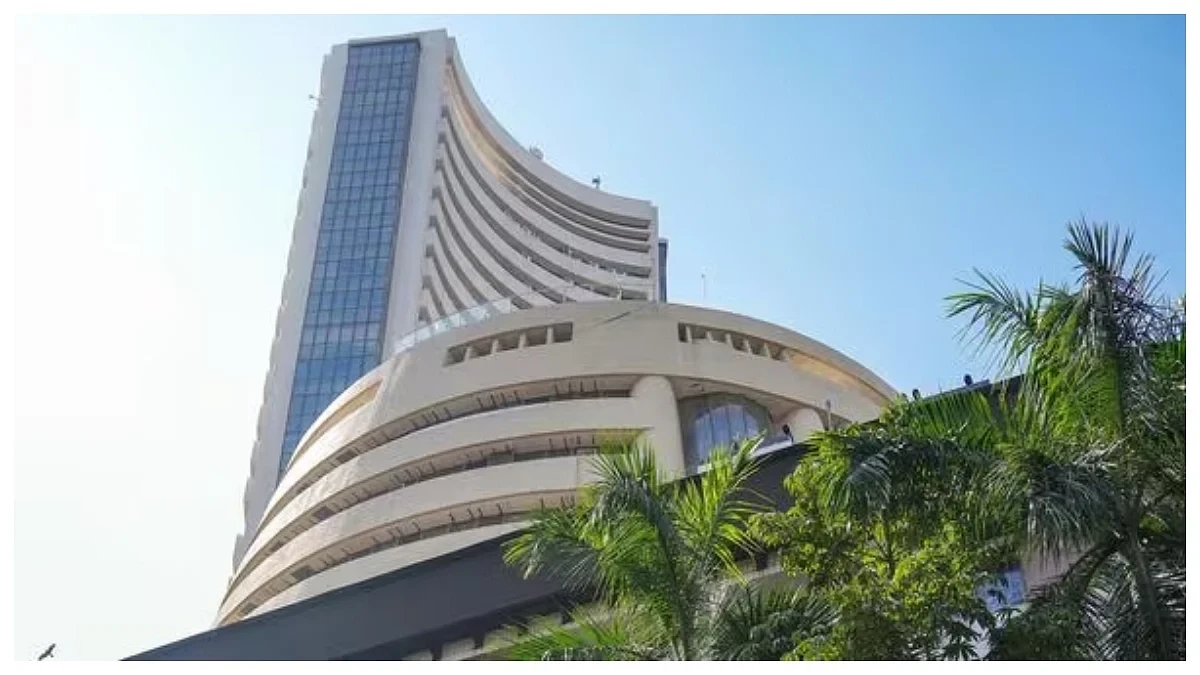

Mumbai: When the stock market to open on Monday, its direction will be shaped by several factors. On Independence Day, Prime Minister Narendra Modi announced a major GST reform, which is expected to influence different sectors in the coming weeks.

What the GST reform means

India is now working towards a simplified two-slab GST structure of 5 percent and 18 percent, while a 40 percent slab will apply to harmful products. The key aim of this reform is to reduce tax on items that people use every day, making them more affordable.

Products and sectors likely to benefit

With this change, big consumer products such as large TVs, air conditioners, cement and automobiles may become cheaper as they are moved from the 28 percent GST bracket to 18 percent. Insurance products are also likely to attract lower GST, which will reduce the financial burden on consumers. A fall in cement prices will especially benefit the real estate sector along with roads, highways and infrastructure, as lower production costs can be passed on to customers.

Market view on GST reform

The stock market is expected to take the GST reform as a positive development. However, quick implementation will be the key. If there is a delay, festive season sales might be postponed because consumers could prefer to wait for lower prices before making purchases. For investors, this reform brings renewed focus on consumption-driven sectors such as FMCG, automobiles and even insurance.

Recent stock market trend

Indian equities recently ended a six-week losing streak and closed with a weekly gain of more than 1 percent. This momentum may continue, with sector-specific action likely in the new week. FMCG and insurance are the two areas where traders may see the most activity.

Nifty levels to watch

In technical terms, the Nifty index now faces strong resistance at the 24,680 level, while support is seen at 24,500. If the index manages to break the resistance, it could move higher into the 24,750 to 24,800 range.