All U.S. TikTok user data would be stored in a trusted, secure and purpose-built cloud environment in the U.S. run by Oracle.

Oracle Corp. (ORCL) shares rose moderately in Thursday’s extended trading after President Donald Trump signed an executive order approving the divestment of a majority stake in TikTok U.S. in favor of a consortium led by the cloud database giant.

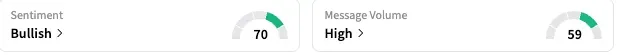

After rising 0.43% in the after-hours session, the gains in Oracle’s stock have increased to nearly a percent in overnight trading. On Stocktwits, retail sentiment toward the stock remained ‘bullish’ (70/100) as of late Thursday, and the message volume stayed at ‘high’ levels.’

Trump’s executive order stated that TikTok’s U.S. operations would be operated by a new joint venture company based in the U.S. following a proposed divestment of a majority stake by the short-video app’s Chinese parent, ByteDance. The planned divestment was required by a law passed by the previous Joe Biden administration, citing security concerns posed by the platform. The law also sought a ban on the platform in the U.S. in the event of non-compliance.

The plan would reduce ByteDance’s stake to less than 20%, with the Chinese company getting only one board representation and being excluded from TikTok U.S.’s security committee.

TikTok would be majority-owned by U.S. investors, operated in the U.S. by a board of directors with national security and cybersecurity credentials, and subject to strict rules to protect Americans’ data and our national security.

The White House statement also stated that Oracle would serve as TikTok’s security provider, monitoring and ensuring the safety of the latter’s operations in the U.S. All U.S. user data would be stored in a trusted, secure, and purpose-built cloud environment in the U.S. run by Oracle. The Trump administration also directed Attorney General Pamela Bondi not to enforce the Biden administration’s TikTok law for 120 days, allowing the divestiture to be completed.

A high-level delegation from the U.S. and China, headed by U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, discussed the proposed deal at talks held in Madrid earlier this month.

Vice President J.D. Vance stated that the new U.S. company would be valued at approximately $14 billion, according to a Reuters report. In an April note, Wedbush analyst Daniel Ives said TikTok’s valuation would be around $100 billion, but without the algorithm, the deal price would be around $30 billion to $40 billion. Citing sources, the Reuters report said an investor group of three, including Oracle and private-equity firm Silver Lake, would jointly acquire a 50% stake in TikTok.

Oracle stock, which has traded within a 52-week range of $118.86 to $345.72, has gained over 76% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<