The NYSE has submitted a formal notice to the SEC confirming its plan to remove the old securities at the start of trading on Oct. 10, 2025, following the company’s exit from Chapter 11 bankruptcy protection and subsequent corporate restructuring.

Wolfspeed Inc. (WOLF) will see its old common stock formally delisted from the New York Stock Exchange following the company’s exit from Chapter 11 bankruptcy protection and subsequent corporate restructuring.

The NYSE submitted a formal notice to the Securities and Exchange Commission (SEC) confirming its plan to remove the old securities at the start of trading on Oct. 10, 2025.

The delisting follows Wolfspeed’s successful completion of its reorganization process. As part of its restructuring, the company has moved its state of incorporation from North Carolina to Delaware. Shareholders of the pre-bankruptcy “Old” Wolfspeed will receive equivalent shares in the “New” Wolfspeed entity.

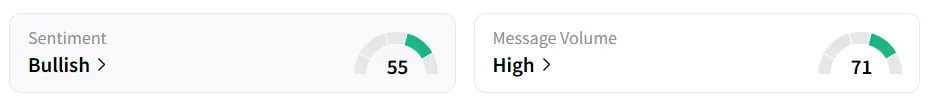

On Stocktwits, retail sentiment around Wolfspeed stock jumped to ‘bullish’ from ‘bearish’ territory the previous day amid ‘high’ message volume levels.

The move follows court approval of Wolfspeed’s prearranged reorganization plan, which includes the cancellation of its old shares and the launch of a new capital structure.

As part of the plan, the company will issue roughly 25.8 million new common shares, each with a par value of $0.00125. Simultaneously, all previously issued shares will be cancelled.

Under the updated rule, the firm is authorized to issue up to 450 million shares in total, comprising 350 million shares of common stock and 100 million shares of preferred stock.

Through the structural overhaul, Wolfspeed expects to reduce its debt by approximately 70% and gain flexibility to attract capital or manage its balance sheet more strategically.

Wolfspeed stock has gained over 124% year-to-date and over 54% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<