Tuesday’s closing price of $207 gave the firm a valuation of $11.84 billion.

Shares of QMMM Holdings were down nearly 60% in premarket trading on Wednesday after the stock saw an astonishing jump in the earlier session.

Investors were seemingly booking profits after the 1,737% jump from Tuesday as QMMM said it plans to establish a diversified cryptocurrency treasury strategy focused on Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The closing price of $207 gave it a valuation of $11.84 billion.

The Hong Kong-based company stated that the treasury, which will initially scale to $100 million, is designed to provide “a foundation for both stability and transparency.” QMMM noted that allocations will prioritize high-quality cryptocurrency assets with long-term growth potential.

The company describes itself as a digital media advertising and virtual apparel technology services company. It said the “expansion” into crypto would integrate its traditional AI business with blockchain technology to create a “next-generation cryptocurrency analytics and crypto-autonomous ecosystem.”

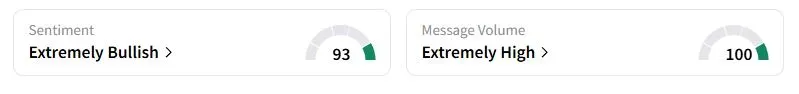

Retail sentiment on Stocktwits about QMMM was in the ‘extremely bullish’ territory at the time of writing, with retail message volume surging over 14,800%.

One user called it a “pump and dump scam” and predicted it to reach $30 on Wednesday.

Cryptocurrency prices have rallied this year due to friendly policies in the U.S., spearheaded by U.S. President Donald Trump. Companies worldwide are rushing to create cryptocurrency treasuries, following the footsteps of Michael Saylor’s Strategy. The company holds over 638,000 Bitcoins, currently valued at over $71 billion.

QMMM stock has jumped nearly 16,000% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<