Oracle faced a bondholder lawsuit on Wednesday that claimed suffering losses over the company’s failure to disclose the need to issue substantial debt to scale its artificial intelligence infrastructure.

- As per a Reuters report, the bondholders who purchased $18 billion of the company’s notes issued in Sept. 2025, were blindsided when the company went back for another $38 billion of loans just seven weeks later.

- The Sept. 2025 bond sale came just two weeks after Oracle signed a $300 billion deal with OpenAI to provide computing power over about five years.

- Meanwhile, technology companies in the U.S. declined on Tuesday.

Shares of Oracle Corp. (ORCL) slumped over 5% on Wednesday after a bondholder lawsuit that claimed suffering losses over the company’s failure to disclose the need to issue substantial debt to scale its artificial intelligence infrastructure.

The slump in ORCL shares came amid a broader decline of tech stocks, with the tech-heavy Nasdaq 100 declining over 1.5% at the time of writing.

Lawsuit Details

The proposed lawsuit, filed in a New York state court in Manhattan, according to a Reuters report, was on behalf of bondholders who purchased $18 billion of notes and bonds that the company issued in Sept. 2025.

The bond sale came just two weeks after Oracle signed a $300 billion deal with OpenAI to provide computing power over about five years. The investors claimed they were blindsided when the company went back for another $38 billion of loans just seven weeks later to bankroll two additional data centers to support the OpenAI agreement.

The complaint held the company, chairman and co-founder Larry Ellison, former CEO Safra Catz, Chief Accounting Officer Maria Smith, and Oracle’s underwriters strictly liable for false and misleading statements in the $18 billion debt sale’s offering documents, as per Reuters.

The bondholders are seeking unspecified damages, as per the report.

Tech Selloff

Meanwhile, technology companies declined on Tuesday.

Chip stocks like Broadcom Inc. (AVGO), Nvidia Corp. (NVDA), and Micron Technology (MU) fell over 4.5%, 1.8% and 2% respectively amid a broader sell off.

How Did Stocktwits Users React?

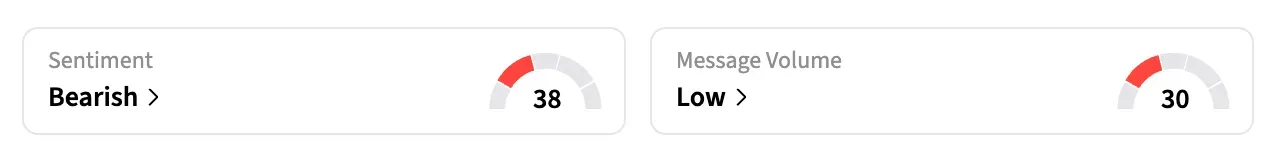

On Stocktwits, retail sentiment around ORCL shares remained in the ‘bearish’ territory over the past day amid ‘low’ message volumes.

Shares of ORCL have gained over 22% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<