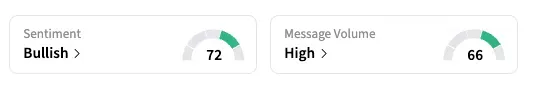

RBC Capital Markets placed a bullish rating on LRCX.

- Lam Research reported strong earnings over the past few quarters, driven by AI-driven strength in its chief customer segment, chipmakers.

- RBC initiated coverage on the company with an ‘Overperform’ and a 25% stock upside forecast.

- Several analysts have raised their price targets on LRCX this month.

Lam Research Corp.’s stock gained by over 5% in early premarket trading on Thursday, following a bullish rating by RBC Capital Markets and a string of price target hikes.

RBC initiated coverage on the semiconductor sector and placed an ‘Outperform’ rating and $260 price target on LRCX. That’s 25% higher than the stock’s last closing price.

That follows upward rating actions by at least nine brokerages, including Bernstein and Goldman Sachs, this month alone.

Lam, which supplies wafer fabrication equipment and services that chipmakers use to produce semiconductors, has posted strong results in recent quarters, which highlighted robust demand, especially in advanced logic and memory segments (AI-related chips), and upbeat China sales.

In October, the company announced a $10 billion share repurchase program and a 10-for-1 stock split, both of which reinforced investor optimism despite geopolitical headwinds, such as China’s export controls.

Currently, 23 of 35 analysts covering the stock recommend ‘Buy’ or higher, 11 recommend ‘Hold,’ and one recommends ‘Strong Sell,’ according to Koyfin. Their average price target of $208.79 implies a 13% upside to the stock’s last closing price.

LRCX stock gained 22% over 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<