The renewable fuel maker posted third-quarter revenue of $42.7 million for the three months ended Sept. 30, while analysts estimated it to post $31.4 million.

- The company said that the Gevo North Dakota ethanol facility is demonstrating reliable energy production, efficient carbon capture, and consistent monetization of tax credits.

- Its third-quarter adjusted EBITDA was approximately $6.6 million, compared with a negative $16.7 million in core profit last year.

- The company said that the suggestion to shift the facility to North Dakota from South Dakota came from the DOE itself.

Gevo stock (GEVO) edged higher in premarket trading on Tuesday after the firm topped Wall Street’s estimates for third-quarter revenue, driven by carbon credit sales and strong ethanol output from its North Dakota unit.

The renewable fuel maker posted third-quarter revenue of $42.7 million for the three months ended Sept. 30, while analysts estimated it to post $31.4 million, according to Fiscal.ai data. Its net loss narrowed to $0.03 per share, compared with $0.09 per share in the same quarter last year.

What Drove Gevo Earnings?

The company’s gains largely came from Gevo North Dakota, an ethanol production facility with a carbon capture and sequestration system. The company said that the site is demonstrating reliable energy production, efficient carbon capture, and consistent monetization of clean fuel production credits or Section 45Z tax credits, based on the production volumes it generates and its carbon intensity score.

Its third-quarter adjusted EBITDA was approximately $6.6 million, compared with a negative $16.7 million in core profit last year. The company has received $29 million by selling carbon credits this year. During the quarter, its ethanol production totaled 17 million gallons, and its protein and corn oil co-products output stood at 46,000 tons.

“In large part, we are a different company than a year ago,” said Gevo CEO Patrick Gruber. “Our consecutive quarter of positive Adjusted EBITDA shows that our baseline business model works. The team is executing, our assets are performing, and we’re creating real value by treating carbon as a co-product and delivering its value to end markets that are most willing and able to pay for it.

What Is Retail Thinking?

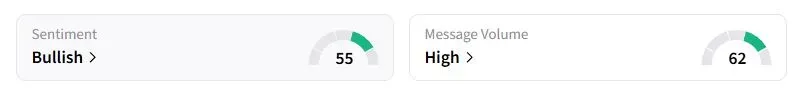

Retail sentiment on Stocktwits about Gevo moved to ‘bullish’ territory compared to ‘bearish’ a day ago, while chatter rose to ‘high.’

“Two consecutive positive earnings are a good sign. Much more to come to see $15,” one user said.

“Fully expect price targets raised!! How can it not?!!! The DOE approached them about expanding at the ND site. Music to Investors’ ears!!!!” another trader wrote.

Gevo Remains Confident On Securing DOE Loan

Last month, the company received an extension from the U.S. Department of Energy on the conditional commitment for a $1.46 billion loan for its upcoming jet fuel production facility. The company said that the suggestion to shift the facility to North Dakota from South Dakota came from the DOE itself.

“I suspect they see the same things we do. Infrastructure already exists. The plants that are there make money, and we can build upon that, and we’ll be working with them to sort it all out, taking advantage of what we learned from our ATJ-60 project. I hope to get the financing for the ATJ-30 plant closed sometime mid-2026,” Gruber said on a call with analysts.

Last year, Gevo and Calumet Inc. secured loan guarantees from the DOE to bolster sustainable jet fuel production in the U.S. However, concerns had arisen about the future of the loans after the Trump administration dialed back many of the Biden administration’s commitments.

U.S. jet fuel consumption is expected to grow by more than 2 billion gallons per year in the next decade, according to data from the U.S. Energy Information Administration. Gevo intends to produce jet fuel from ethanol rather than the more common cooking oil.

Gevo stock has gained 2.4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<