According to TheFly, Roth Capital raised the price target for the stock to $30 from $11 and kept the rating at ‘neutral.’

- Last week, Canadian Solar posted revenue of $1.49 billion for the quarter ended Sept. 30, compared with the $1.37 billion estimated by Wall Street.

- Roth analysts reportedly attributed the stock’s 177% rally since its second-quarter earnings report to a bullish battery outlook, driven by data centers and possible “meme-stock-like buying from Chinese investors.”

- The brokerage flagged that it remains on the sidelines, citing “significant policy risk” for Canadian Solar under the Foreign Entity of Concern provisions.

Canadian Solar stock (CSIQ) gained 1.6% in premarket trading on Monday after Roth Capital turned more bullish on the stock.

According to TheFly, Roth Capital raised the price target for the stock to $30 from $11 and kept the rating at ‘neutral.’ The new price target implied 4.8% upside from the stock’s previous close.

Bullish Outlook, But Possible US Export Restrictions Could Pose A Headache

Last week, Canadian Solar posted revenue of $1.49 billion for the quarter ended Sept. 30, compared with the $1.37 billion estimated by Wall Street. Sales rose 1% year over year, aided by its robust order book for battery storage.

Roth analysts reportedly attributed the stock’s 177% rally since its second-quarter earnings report to a bullish battery outlook, driven by data centers and possible “meme-stock-like buying from Chinese investors.” However, the brokerage flagged that it remains on the sidelines, citing “significant policy risk” for Canadian Solar under the Foreign Entity of Concern provisions.

The U.S. has imposed fresh restrictions and raised tariffs on solar imports after several domestic makers accused Chinese firms of flooding the market. Last week, Canadian Solar CEO Shawn Qu stated that the firm expects to meet the requirements for solar shipments to the U.S., and it plans to ramp up its manufacturing in the country.

What Are Stocktwits Users Thinking?

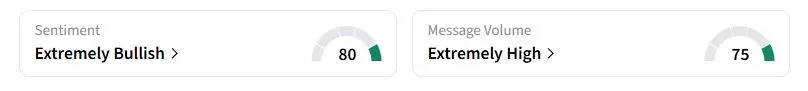

Retail sentiment on Stocktwits about Canadian Solar was in the ‘extremely bullish’ territory at the time of writing, while chatter was ‘extremely high.’

Canadian Solar stock has nearly tripled this year, compared with 42.3% gains of First Solar, the biggest U.S. solar panel maker.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<