The stock has risen 45% this week amid optimism surrounding its Tonopah Flats Lithium Project in Nevada.

American Battery Technology (ABAT) stock slumped over 24% in premarket trading on Thursday after the U.S. Department of Energy terminated a grant for the company’s lithium hydroxide project.

The DOE under former President Joe Biden’s administration awarded the $57.7 million grant to the company in 2023 through its Manufacturing Energy Supply Chain office for the design, construction, commissioning, and operation of a commercial-scale facility to manufacture battery cathode-grade lithium hydroxide.

The firm said the DOE informed it about the termination on Oct. 9. It had approximately $52 million of reimbursable DOE funds remaining on the Assistance Agreement. The company said that it submitted an appeal to overturn the decision; however, it affirmed that the project will proceed irrespective of the outcome.

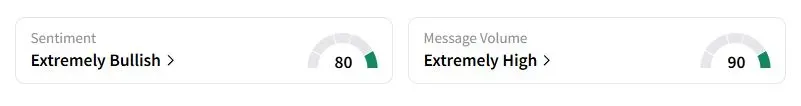

Retail sentiment on Stocktwits about American Battery Technology was in the ‘extremely bullish’ territory at the time of writing.

The termination will likely throw a wrench into the stock’s recent momentum, given the ongoing trade tensions between the U.S. and China.

Earlier this week, the company’s manufacturing ambitions got a boost after it cleared a key regulatory hurdle in the U.S. by completing all baseline studies required under the National Environmental Policy Act (NEPA) for its Tonopah Flats Lithium Project (TFLP) in Nevada. These baseline reports were filed with the U.S. Bureau of Land Management (BLM), a necessary step before formal environmental review can begin.

In June 2025, TFLP was designated a Transparency Priority Project by the FAST-41 Permitting Council and the National Energy Dominance Council (NEDC) under a 2025 executive order, aimed at fast-tracking key mineral projects. The status was later elevated to a “Covered Priority Project,” placing it among a select group of projects that may benefit from permit acceleration and interagency coordination. The company said on Wednesday that the priority project status for TFLP will remain unaffected despite the termination of the grant.

American Battery Technology’s stock has more than tripled this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<