The company’s Q3 revenue of $285 million and EPS of $0.51 came in below the consensus estimate.

- A Benchmark analyst cited that the company’s updated outlook reflects broad-based demand weakness.

- Goldman Sachs reduced its price target to $63 from $73, while maintaining a ‘Buy’ rating.

- Truist stated that the management’s decision to scale back Q4 production will weigh on margins.

Trex Company Inc. (TREX) saw several Wall Street firms lower their price targets on Wednesday after the company reported weaker-than-expected third-quarter (Q3) results and trimmed its full-year 2025 outlook.

The company’s Q3 revenue increased 22.1% year-over-year (YoY) to $285 million. Adjusted earnings per share (EPS) were $0.51. Both revenue and EPS came in below the analysts’ consensus estimate of $301.73 and $0.57, respectively, according to Fiscal AI data.

Broad Demand Slowdown

Benchmark analyst Reuben Garner reduced the firm’s price target on Trex to $40 from $80 while maintaining a ‘Buy’ rating, according to TheFly. Garner said the company’s updated outlook reflects broad-based demand weakness and channel destocking as the year comes to a close.

He warned that the market might assume Trex will need to boost spending or accept thinner margins to defend market share, which could pressure the stock’s valuation until clearer evidence suggests otherwise.

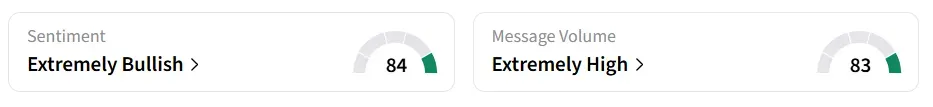

Trex Company’s stock traded over 27% lower on Wednesday morning. However, on Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day. Message volume improved to ‘extremely high’ from ‘normal’ levels in 24 hours.

What Do Goldman Sachs and Truist Say?

Goldman Sachs reduced its price target to $63 from $73, while maintaining a ‘Buy’ rating. The firm noted that while Trex’s Q3 revenue and margins fell short due to softer demand and channel de-stocking, profitability still improved year over year.

Truist Securities lowered its target to $50 from $75 but maintained its ‘Buy’ rating. The firm stated that the management’s decision to scale back Q4 production aims to prevent excess inventory but will weigh on margins.

Trex’s stock has lost over 52% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.