The stock came under pressure after Amazon.com Inc. and Netflix Inc. announced a global advertising partnership on Wednesday, and Morgan Stanley announced a downgrade with a price target cut.

Trade Desk Inc. (TTD) stock drew significant investor interest on Wednesday after the shares tumbled 9% by the afternoon trading session.

The stock came under pressure after Amazon.com Inc. (AMZN) and Netflix Inc. (NFLX) announced a global advertising partnership on Wednesday. The partnership will give brands greater access to premium streaming inventory on one of the world’s most popular platforms.

The deal enables advertisers using Amazon’s demand-side platform (DSP) to directly purchase ad space on Netflix across 12 major markets, including the U.S., the U.K., Canada, Germany, Japan, and Brazil, beginning in the fourth quarter of 2025.

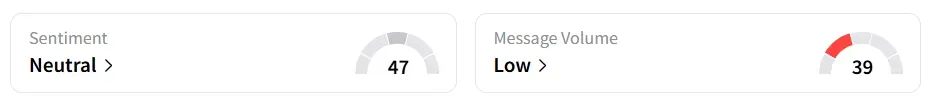

On Stocktwits, retail sentiment around the stock improved to ‘neutral’ from ‘bearish’ territory the previous day. Message volume shifted to ‘low’ from ‘extremely low’ levels in 24 hours.

A Stocktwits user highlighted the Amazon-Netflix news and a downgrade from Morgan Stanley.

The company’s advertising platform enables advertisers to discover new audiences and expand their brands.

Meanwhile, Morgan Stanley downgraded the stock from ‘Overweight’ to ‘Equal Weight’ and slashed its price target from $80 to $50, according to TheFly. Analyst Matthew Cost acknowledged that the firm had misjudged the company’s growth trajectory.

Morgan Stanley pointed out that a more challenging outlook for 2025 awaits the company, particularly in connected TV advertising. The analyst cited increasing pressure from rivals and a more cautious spending environment in the open internet ad market. Beyond broader industry shifts, Morgan Stanley expressed concern over The Trade Desk’s operational delivery.

Trade Desk stock has lost over 59% of its value year-to-date and more than 52% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<