Splash Beverage reported nil revenue in its delayed interim Q3 filing, raising grave concerns.

- Splash Beverage reported nil revenue in its delayed interim Q3 filing, raising grave concerns.

- Earlier this month, the company’s chief executive and finance chief resigned.

- Stocktwits sentiment for SBEV shifted to ‘bullish’ from ‘neutral,’ following a sharp slide in shares in recent months.

Splash Beverage Group, Inc. shares rose about 28% to just under $1 in early premarket trading on Friday, following significant developments at the company this month and investors reacting to its interim third-quarter report, released after a delay on Wednesday.

Splash Beverage, which sells Chispo tequila and Copa Di Vino wine, reported nil revenue for the September quarter. That’s compared to $981,858 in the year-ago quarter. Net loss came in at $9.9 million, compared to a $4.7 million loss a year ago.

Earlier this month, the company’s CEO and Board Chair, Robert Nistico, and CFO, William Devereux, resigned. Board member Bill Caple took over as the chairman on Nov. 14., with the company launching a search for the next CEO.

Retail’s View

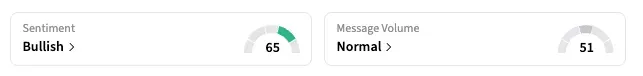

On Stocktwits, the retail sentiment for SBEV shifted to ‘bullish’ as of early Friday, up from ‘neutral,’ although users were concerned of critical updates.

“Another late filing. My guess is they don’t want shareholders to know how bad it is. Maybe why the both the CEO and CFO resigned,” a bearish used said.

The stock has suffered massive erosion in value due to liquidity concerns at the beverage seller, forcing the company to cut back on operations. Over the past year, the company converted certain debt to equity and authorized the issuance of new shares to improve its balance sheet position. SBEV is down over 88% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<