The company announced strong topline results from its ALKOVE-1 Phase 1/2 trial, evaluating its investigational drug Neladalkib.

- In 253 TKI-pre-treated patients, the review found an objective response rate (ORR) of 31%.

- In a subgroup of 63 lorlatinib-naïve patients, the ORR rose to 46%.

- Stifel raised its price target on the stock to $135 from $115 and reiterated a ‘Buy’ rating.

Nuvalent, Inc. (NUVL) shares were in the spotlight on Monday after the company announced strong topline results from its ALKOVE-1 Phase 1/2 trial, evaluating its investigational drug Neladalkib in patients with advanced ALK-positive non-small cell lung cancer (NSCLC)

The patients in the trial have previously received tyrosine kinase inhibitors (TKIs).

Clinical Data Highlights

In 253 TKI-pre-treated patients, the review found an objective response rate (ORR) of 31%, with estimated durations of response of 64% and 53% at 12-month and 18-month marks, respectively.

In a subgroup of 63 lorlatinib-naïve patients, the ORR rose to 46%, with estimated 12- and 18-month response durability of 80% and 60%, respectively.

Neladalkib demonstrated activity in tumors within the brain (intracranial responses), targeting key drivers of disease progression. The safety profile also appeared manageable, with only 5% of patients stopping treatment and 17% reducing the dose.

What Is The Next Step?

Nuvalent plans to review these results with the U.S. Food and Drug Administration at a pre-New Drug Application (NDA) meeting. Following the trial results, Nuvalent’s stock traded over 15% higher on Monday afternoon.

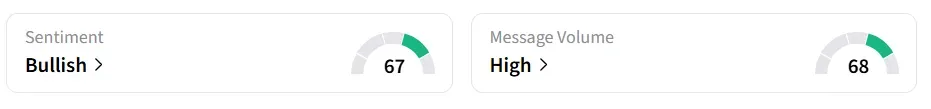

On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory the previous day. Message volume improved to ‘high’ from ‘normal’ levels in 24 hours.

Wall Street’s Response

Leerink analyst Stephen Gengaro boosted his target on the stock to $149 from $140, maintaining an ‘Outperform’ rating after reviewing the topline results, according to TheFly.

He stated that the data validate Neladalkib’s design, particularly its ability to target both single and compound ALK resistance mutations, signaling longer-lasting responses in ALK-positive non–small cell lung cancer (NSCLC).

Stifel raised its price target to $135 from $115 and reiterated a ‘Buy’ rating, citing ‘highly encouraging’ data.

NUVL stock has gained over 42% in 2025 and over 27% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<