New Era Energy & Digital has entered into a land option purchase agreement for about 3,500 acres in New Mexico to develop a large-scale AI data center campus.

- The project aims to create a multi-gigawatt hub featuring over two GW of natural gas generation and a planned 5+ GW nuclear installation.

- Engineering work is set to begin within 30 days.

- The site was chosen for its access to major gas pipelines and robust power infrastructure.

Shares of New Era Energy & Digital, Inc. (NUAI) shot up 21% in premarket trade after the company announced that it had entered into a land option purchase agreement for about 3,500 acres in Lea County, New Mexico, to develop a large-scale AI data center campus.

The project aims to create a multi-gigawatt hub featuring over two gigawatts (GW) of natural gas generation and a planned nuclear installation of over 5 GW, with initial power delivery targeted for 2028. The site was chosen for its access to major gas pipelines and robust power infrastructure.

Site Evaluations

Engineering work will commence within 30 days to conduct comprehensive site evaluations and develop a master plan. New Era has secured a gas supply and is finalizing the selection of technology for its nuclear component, it stated.

The project is New Era’s first fully owned development, separate from the Texas Critical Data Centers (TCDC) joint venture. TCDC is a JV between Sharon AI and New Era.

New Era said it intends to provide powered shell buildings and powered land lease options for AI-driven enterprises through a vertically integrated model, which accelerates deployment timelines and reduces tenant costs.

What Are Stocktwits Users Saying?

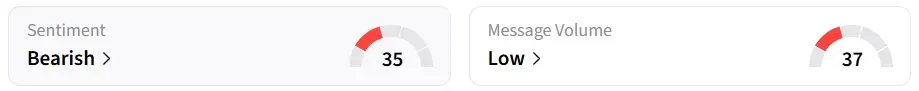

Despite the premarket surge, retail sentiment for NUAI on Stocktwits has remained in the ‘bearish’ territory over the past 24 hours. At the time of writing, the stock was among the top trending tickers on the platform.

While some Stocktwits users were bullish about the development, expecting the stock’s price target to shoot up, others were apprehensive about the financing.

NUAI shares have declined 12% so far this year despite a 225% surge over the past month.

For updates and corrections, email newsroom[at]stocktwits[dot]com<