- Integer reduced its 2025 revenue and adjusted EPS forecasts, citing broader market challenges.

- Incoming CEO Payman Khales warned that slower adoption of new products will affect performance over the next three quarters.

- Despite the revised outlook, Integer posted strong Q3 results.

Integer Holdings Corp. (ITGR) stock hit January 2023 lows on Thursday after the company revised its 2025 guidance, lowering both revenue and adjusted earnings per share (EPS) amid market headwinds.

During the third-quarter (Q3) earnings call, the company’s incoming CEO, Payman Khales, cautioned that a recent shift in customer demand for certain products will weigh on the financial performance over the next few quarters.

“Despite this strong third quarter, we recently received customer updates related to the adoption of new products in the market that we expect will impact the next 3 quarters.”

-Payman Khales, Incoming CEO, Integer.

“The magnitude of these changes on multiple products at the same time is highly unusual,” he said.

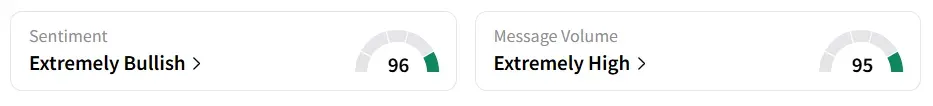

Integer stock traded over 40% lower on Thursday afternoon. However, on Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ the previous day. Message volume improved to ‘extremely high’ from ‘low’ levels in 24 hours.

Revised Outlook

The comments come on the heels of a strong Q3 earnings report, highlighting both the company’s growth momentum and the challenges tied to evolving product adoption trends.

Integer now expects its 2025 sales to be in the range of $1.84 billion to $1.85 billion, down from the previous guidance of $1.85 billion to $1.87 billion. The adjusted EPS outlook has also been trimmed to $6.29 to $6.43, from the previous $6.25 to $6.51.

According to Khales, the downward revision reflects reduced demand in its Cardiac Rhythm Management & Neuromodulation (CRM&N) segment, particularly among emerging customers with pre-market approval (PMA) products.

Revenue And EPS

The medical device manufacturer reported a Q3 revenue of $468 million and an adjusted EPS of $1.79, both exceeding the analysts’ consensus estimate of $466.45 million and $1.68, respectively, according to Fiscal AI data.

Adjusted operating income rose 14% year-on-year (YoY) to $86 million, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased 11% YoY to $106 million.

Integer Holdings’ stock has lost over 41% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<