Ichor expects a tough fourth quarter, forecasting a revenue of $210 million to $230 million.

- Ichor Holdings’ stock declined after brokerages downgraded the stock and cut its price target

- The company’s chief executive stated that he expects a weak fourth quarter.

- Ichor’s Q3 revenue exceeded street estimates, but EPS fell short.

Shares of Ichor Holdings (ICHR) slumped 30% on Tuesday, after a series of brokerage downgrades following the company’s weak fourth-quarter guidance.

Stifel downgraded Ichor to “Hold” from “Buy” and cut its price target to $21 from $23, citing weaker-than-expected third-quarter (Q3) results and a soft fourth-quarter (Q4) outlook, according to TheFly. The firm noted that 2026 will likely serve as a transition year for Ichor and stated that it prefers to wait on the sidelines to assess incremental progress before becoming more positive.

Meanwhile, DA Davidson maintained a “Buy” rating but lowered its price target to $30 from $35, highlighting that the stock’s recent decline reflects weak Q4 guidance. The firm attributed the softness to Q3 pull-ins from Ichor’s two largest customers, anticipated weakness from its third- and fourth-largest clients, and project delays in its highest-margin segment, which collectively weighed on near-term visibility.

Q3 Results

The company reported mixed third-quarter 2025 results, with revenue exceeding expectations but earnings per share (EPS) falling short of expectations. The company reported revenue of $239.3 million, a 13% increase year-over-year and exceeding estimates of $235.14 million. However, EPS came in at $0.07, missing the street estimates of $0.12.

The management expects Q4 2025 to be a challenging quarter, forecasting revenue of $210 million to $230 million and gross margins of 10% to 12%.

How Did Stocktwits Users React?

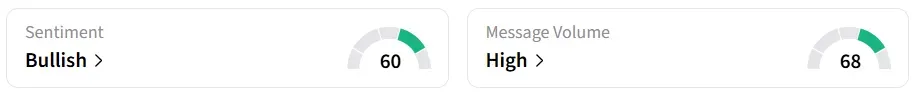

Despite the sharp intraday decline, retail sentiment flipped to ‘bullish’ from ‘bearish’ a day ago, accompanied by ‘high’ message volumes.

Users have remained bullish, with one expected to buy the dip.

Year-to-date, the ICHR stock has halved in value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<