The company had recently raised $232.1 million gross proceeds after the exercise of 26.5 million warrants.

Enovix (ENVX) stock fell 12.7% in extended trading on Wednesday after the company signaled its intent to offer $300 million in convertible debt.

The silicon battery technology company said it also plans to grant the first buyers of the bonds an option to purchase up to an additional $60 million worth of debt within a 13-day period beginning on, and including, the date on which the notes are first issued.

The firm noted that the notes will be convertible only into cash, shares of Enovix common stock, or a combination of cash and shares under specific events. Enovix intends to primarily use the proceeds to buy other companies, which will help it reach additional markets.

In April, Enovix acquired a battery cell manufacturing facility from struggling solar inverter maker SolarEdge to bolster its defense equipment portfolio.

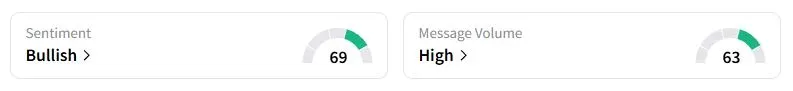

Retail sentiment on Stocktwits about Enovix was in the ‘bullish’ territory at the time of writing.

The debt offering comes less than a week after the company said it had raised $232.1 million gross proceeds after the exercise of 26.5 million warrants.

In the second quarter, the company’s revenue nearly doubled to $7.5 million while its net loss narrowed to $0.22 per share, compared with $0.63 per share loss a year earlier.

Enovix is moving close to commercialization amid ongoing talks with key customers across industries. It is betting on its A1 battery technology and expects to begin mass production after receiving all the necessary certifications.

“Must mean they have more orders than they anticipated,” one user wrote.

“In all reality, if you still have any belief in management, now is the time to buy. They have to release positive news to not lose all credibility, and they know it,” another user wrote.

Enovix stock has fallen 17% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<