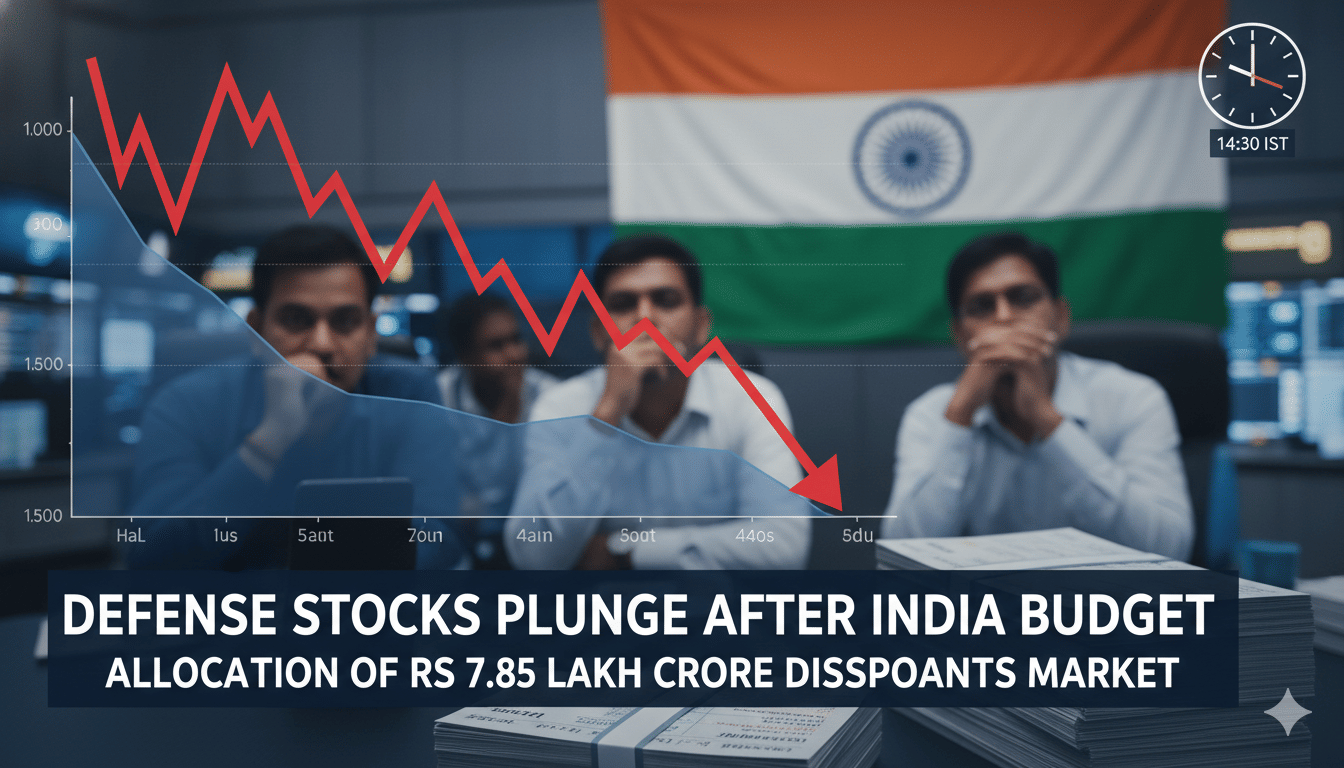

New Delhi: The Union Budget 2026-27 had the highest allocation for the Defense sector, but it failed to lift the mood in the stock market as a sharp decline was recorded in the shares of the defence sector. The Budget presented by Finance Minister Nirmala Sitharaman had an allocation of Rs 7.85 lakh crore for the defence, which is the highest among all ministries. According to the Ministry of Defense, this amount is about 2 per cent of the estimated GDP of 2026-27. The allocation is 15.19 percent more than last year’s budgetary estimate.

A day after the Budget 2026 was announced, the shares of defence companies declined fell by around 5 percent. The Nifty Defence Index went down by 1.76 percent; the inex fell 5.6 percent on February 1 (Sunday). The stocks of Mazagon Dock Shipbuilders, Cochin Shipyard, Garden Reach Shipbuilders, ITI, HAL, and Bharat Dynamics, traded lower at the time of writing this article on Monday. Bharat Dynamics shares fell about 6 percent, while HAL and shipbuilding companies recorded losses ranging from 1 to 3 percent.

- HAL share trading at Rs 4,260.80 apiece, a loss of 2.65 per cent.

- Cochin Shipyad stock traded with 3.71 per cent loss at Rs 1,497 apiece.

- Garden Reach Shipbuilders shares declined nearly 1 per cent to Rs 2,499.60.

- Bharat Dynamics stock fell 6.64 per cent to Rs 1,292.20.

- Mazagon Dock Shipbuilders shares went down 1.11 per cent to Rs 2,368.

What experts said on decline in defence shares

Market experts are of the view that say that investors expected some major policy announcement or new reforms for the defence sector in Budget 2026. Although the capex was increased, there was a lack of any concrete roadmap for ‘Make in India’, large private sector participation or new orders.