The company said that the proposed acquisition of TC BioPharm will strengthen and deepen its expertise and knowledge in using allogeneic cell therapies for cancer treatment.

CytoMed Therapeutics (GDTC) announced on Tuesday that it has submitted a cash bid for an undisclosed sum to the joint administrators of TC BioPharm, effective October 2, for the potential acquisition of its assets.

The proposed acquisition will strengthen and deepen CytoMed’s expertise and knowledge in using allogeneic cell therapies for cancer treatment, the company said. The company added that this will help it accelerate its commercialization timeline.

TC BioPharm and CytoMed are both clinical-stage biopharmaceutical companies engaged in the research and development of donor-derived allogeneic gamma delta T cells for cancer treatment. While TC BioPharm has completed an early-stage clinical trial, CytoMed is currently conducting an early-stage trial in Singapore, evaluating its chimeric antigen receptor (CAR) T cells for a broad range of liquid and solid cancers.

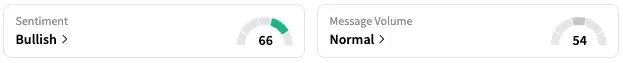

The proposed acquisition will be funded by internal resources, the Singapore-based CytoMed said. Shares of the company traded 19% higher at the time of writing. On Stocktwits, retail sentiment around GDTC stock rose from ‘bearish’ to ‘bullish’ territory over the past 24 hours, while message volume rose from ‘low’ to ‘normal’ levels.

A Stocktwits user believes the stock might be gearing up for a breakout soon.

CytoMed acquired certain assets of Cellsafe International Sdn Bhd, a Malaysian cord blood bank, in October 2024. The acquisition included a cord blood banking license issued by Malaysia’s Ministry of Health, cryopreservation equipment with more than 12,000 cord blood units, and two freehold real estate properties in which the operation is situated.

TC BioPharm is a unit of TC BioPharm Holdings Plc, which was listed on the Nasdaq until March earlier this year. The company said earlier this month that its directors have appointed Michael Magnay and Rob Croxen of Alvarez and Marsal Europe LLP as joint administrators to its unit to explore options for the sale of the business and assets. The company also said that the parent company continues to operate as usual.

GDTC stock is down by 33% this year and up by about 6% over the past 12 months.

Read also: Candel Therapeutics Enters $130M Term Loan Facility To Advance Lead Product Candidate In Treatment Of Lung Cancer

For updates and corrections, email newsroom[at]stocktwits[dot]com.<