The SEC probe was reportedly initiated following a whistleblower complaint earlier this year, as well as a series of short reports.

Mobile app marketing platform AppLovin Corp.’s (AAP) stock fell over 2% in the early premarket session on Tuesday, signaling that the stock is on track to extend its fall.

Stung by a Bloomberg report, citing people familiar with the matter, that the company is under the SEC’s scrutiny, AppLovin’s stock fell sharply in the final minutes of trading on Monday. At the close, the stock was down 14.03% at $587, off the day’s high of $687. Intraday, the stock shed as much as 20% before making up some of the loss. The decline was accompanied by nearly double the stock’s average volume.

The report stated that the securities regulator has been investigating AppLovin’s data collection practices, specifically to determine whether the company had violated platform partners’ service agreements by serving more targeted advertising to consumers. SEC’s enforcement officials assigned to cyber and emerging technologies are reportedly leading the probe.

The probe was initiated following a whistleblower complaint earlier this year, as well as a series of short reports. The report clarified that the SEC has not yet accused AppLovin of any wrongdoing, and it also stated that it was unclear how far the review had progressed.

Responding to Bloomberg’s request for clarification via email, AppLovin reportedly said, “We regularly engage with regulators and if we get inquiries we address them in the ordinary course,” adding that “Material developments, if any, would be disclosed through the appropriate public channels.”

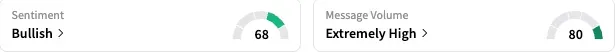

On Stocktwits, retail sentiment toward the stock flipped to ‘bullish’ early Tuesday from ‘extremely bearish’ a day ago. Retail chatter on the stream was ‘extremely high,’ with the 24-hour message volume change leading up to late Monday up a whopping 8,300%.

A bullish watcher called the stock sell-off an “overreaction,” stating that the company has a “decent” business.

Another user cried foul over the plunge, calling the “doom and gloom” headline a ploy for hedge funds to buy the stock at a cheap price.

AppLovin stock has hit an all-time (intraday high) of $745.61 on Sept. 29 despite the overhangs and is up 81% for the year-to-date period, even after accounting for Monday’s sell-off.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<