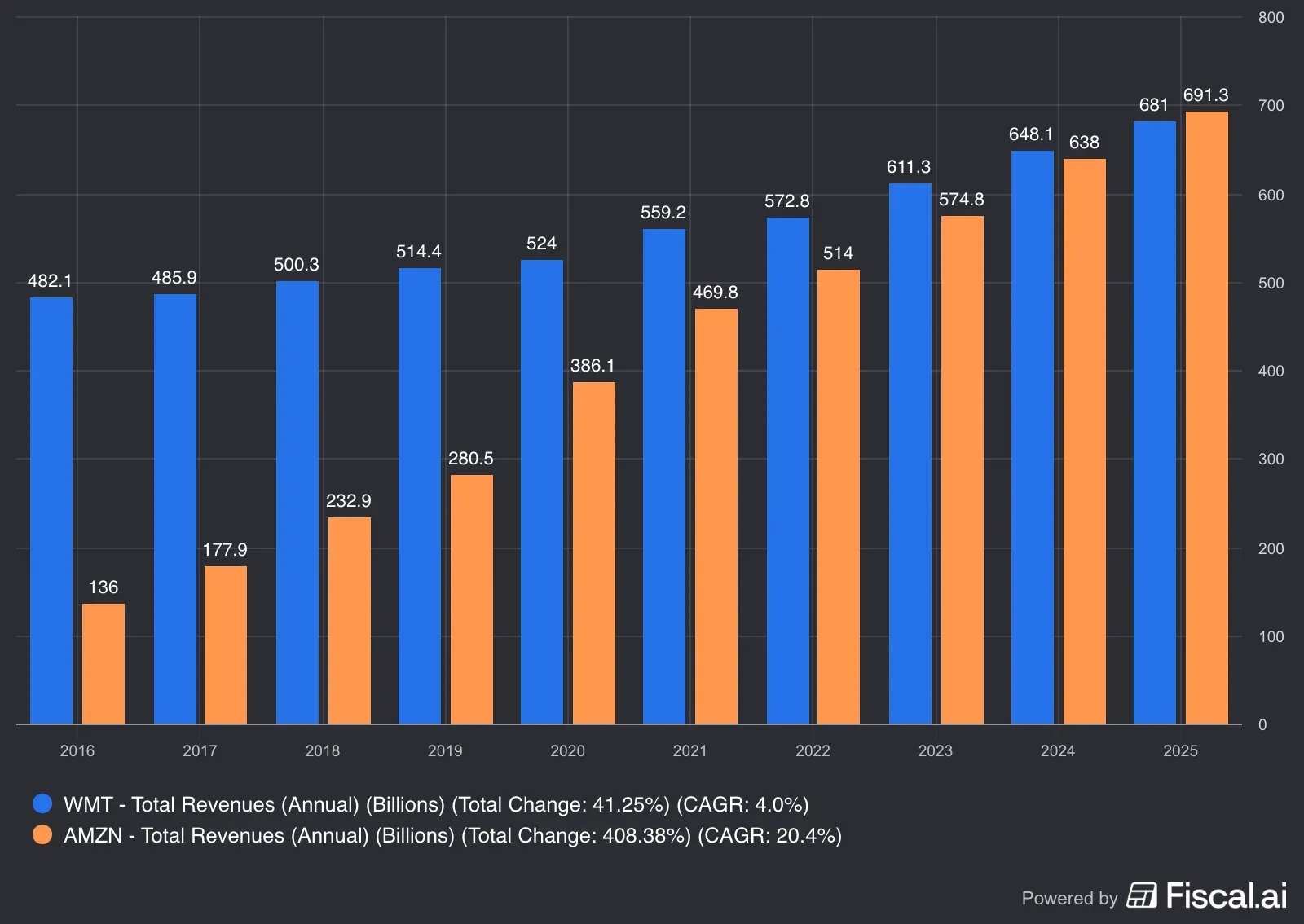

Analysts expect Amazon to report $691.3 billion in revenue for 2025, surpassing Walmart’s projected $681 billion for the company’s fiscal year ending in January 2026.

- Analysts expect Amazon to report $691.3 billion in revenue for 2025, surpassing Walmart’s projected $681 billion.

- That would be the first time the e-commerce giant’s topline would have surpassed that of the nation’s largest retailer.

- Both Amazon and Walmart reported strong results for the last quarter.

Amazon.com, Inc. is poised to earn more revenue than Walmart, Inc. for the first time this year, according to analysts’ projections — a significant milestone that underscores the ongoing shift to e-commerce and the growing influence of Big Tech companies in the stock market.

Fourth quarter estimate put Amazon’s 2025 total revenue at $691.3 billion and Walmart’s at $681 billion, according to Fiscal.ai. In the last few years, Amazon has been closing the gap with Walmart, with its about 20% topline compound annual growth rate (CAGR). On the other hand, Walmart’s growth rate is about 4%.

The AWS Kicker

To be sure, it’s not an apples-to-apples comparison. Amazon has a hugely profitable cloud unit, which contributed about 17% to the company’s topline.

In the era of artificial intelligence (AI), Amazon Web Services has become even more pertinent to investors valuing Amazon’s business and its stock. The growth rate at the world’s largest hyperscaler, while below competitors like Microsoft’s Azure and Google Cloud, often determines how Amazon’s stock moves quarter over quarter.

That said, the key here is also how Amazon has expanded its already dominant position in e-commerce. The company’s revenues from its “North America” and “International” segments, which chiefly comprise e-commerce sales, were $484.03 billion in 2024. That figure increased by 9.6% in 2024, while the year-earlier pace was 11.6%.

Bentonville, Arkansas-based Walmart reported $680.9 billion in total revenue for its fiscal year 2025, which ended in January 2025. Reducing e-commerce net sales in the U.S. and international markets, and from Sam’s Club, leaves us with an estimated $560 billion in sales from Walmart’s physical stores.

That essentially means Walmart’s sales from its physical stores were higher than Amazon’s online sales, at least till last year. Walmart, however, is pushing the pedal on e-commerce and said its global e-commerce sales grew 27% last quarter.

AMZN vs WMT

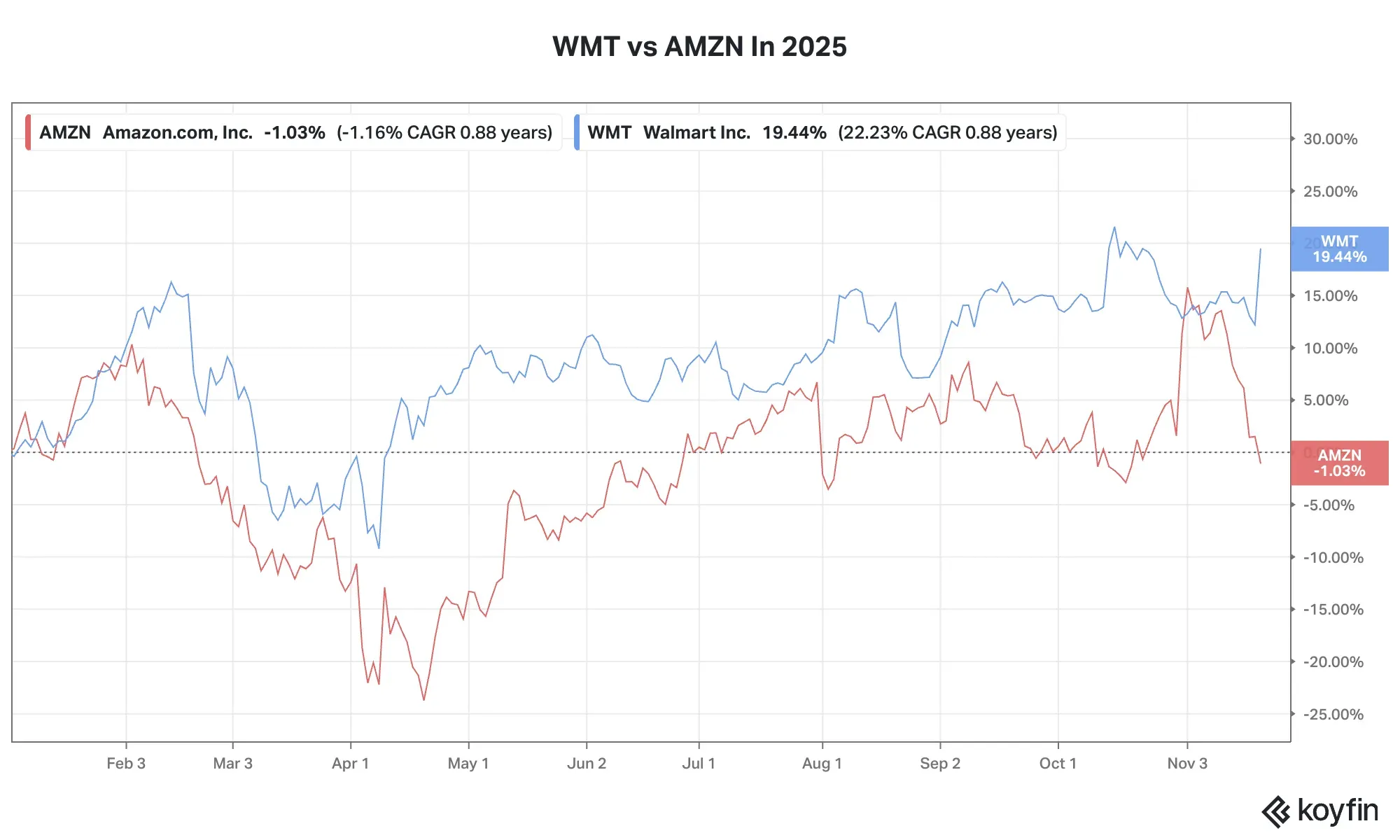

For better or worse, investors are buying Walmart shares because of the company’s strong reliance and performance compared to peers amid challenging consumer and economic trends. But for Amazon, its exposure to the consumer retail market is a drag. So far this year, WMT has gained 18.6%, while Amazon’s shares are down 1%.

At the moment, Amazon is relatively undervalued. Its shares trade at 29.2 times the 12-month forward price-to-earnings (P/E), compared with Walmart’s 37.5 times. Forward P/E is a key metric investors use to value equities.

Interestingly, Walmart has recently been advancing in digital and AI technologies (including the ChatGPT integration) and now wants to be seen as more of a tech company than a retailer. Walmart announced this week that it will shift WMT stock to the Nasdaq Global Select Market from the New York Stock Exchange on Dec. 9, a move that marks the biggest exchange transfer in the NYSE’s history and could open it to investment from tech-focused funds.

On Stocktwits, the retail sentiment for AMZN has turned ‘bearish’ from ‘bullish’ a year ago, amid a 22% jump in message volume and 5% rise in followers. Meanwhile, WMT retail traders have remained ‘extremely bullish’ over the same period, accompanied by a 142% surge in message volume and over 7% jump in followers, indicating a greater rise in interest and confidence between the two stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<