KeyBanc upgraded Intel’s stock to ‘Overweight’ from ‘Sector Weight’ with a price target of $60.

- KeyBanc pointed to strong demand from cloud service providers and hyperscalers as key drivers of the optimistic view.

- The firm suggested that major cloud operators are placing heavy orders for Intel’s latest server processors.

- On January 5, Intel launched its new Core Ultra Series 3 laptop processors.

Intel Corp (INTC) stock climbed over 3% higher in Tuesday’s premarket after receiving a rating boost from KeyBanc Capital Markets, sparking interest in the chipmaker’s stock among market participants.

KeyBanc upgraded Intel’s stock to ‘Overweight’ from ‘Sector Weight’ with a price target of $60, according to TheFly. The upgrade underlined expectations for demand tied to data center computing and artificial intelligence growth.

Analyst Rationale

KeyBanc pointed to strong demand from cloud service providers and hyperscalers as key drivers of the optimistic view. The upgrade reflects growing belief that server and AI workloads could give Intel’s revenue a meaningful push in 2026.

The firm suggested that major cloud operators are placing heavy orders for Intel’s latest server processors, effectively committing much of the company’s 2026 supply. That tight supply backdrop, according to the firm, could translate into pricing power and stronger top-line performance across Intel’s data center business.

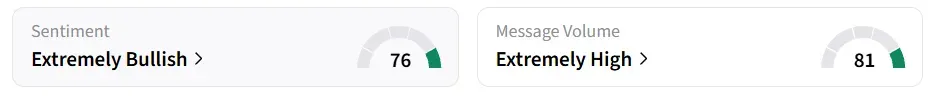

On Stocktwits, retail sentiment around Intel stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Foundry Progress

Keybanc also cited improvements in Intel’s manufacturing yields for its 18A process, which are advancing toward levels needed to support higher volume production of next-generation chips.

On January 5, Intel launched its new Core Ultra Series 3 laptop processors. Named “Panther Lake,” these chips use Intel’s 18A process, similar to a 2-nanometer node, and are described as the most advanced U.S.-made semiconductor technology. The company says it offers 60% higher performance than the previous Lunar Lake Series 2 processors.

The company’s latest chip also received praise from President Donald Trump. In August 2025, the U.S. government acquired a 10% stake in Intel, making it the company’s largest shareholder.

Intel is scheduled to report its fourth-quarter (Q4) earnings on January 22. Analysts expect a Q4 revenue of $13.368 billion and earnings per share of $0.08, according to FiscalAI data.

INTC stock has gained over 129% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<