GCT Semiconductor Holding announced a licensing agreement with a leading satellite communications provider on Thursday.

- The company said that it had licensed 5G and 4G chipsets to one of the world’s largest satellite communications providers, without naming the partner.

- The 5G product shipments related to this agreement would likely start in the second half of 2026, the company said.

- The deal would also open up opportunities for future chipset sales, the company said.

Shares of GCT Semiconductor Holding Inc. (GCTS) rallied over 42% on Thursday after the company announced a licensing agreement with a leading satellite communications provider.

The company said that it had licensed 5G and 4G chipsets to one of the “world’s largest satellite communications providers,” without naming the partner.

The 5G product shipments related to this agreement would likely start in the second half of 2026, the company said.

Deal Contours

The licensing agreement would allow integrating the company’s 5G and 4G chipsets into the satellite provider’s user equipment. This would enable global, reliable, and high-speed connectivity via satellite and terrestrial networks.

The deal would also open up opportunities for future chipset sales, the company said, citing the satellite provider leveraging its new 5G chipset that supports direct-to-satellite applications within its network.

“This collaboration positions both companies at the forefront of emerging and growing 5G-to-space networks that aim to deliver coverage globally, including underserved regions, and aims to accelerate the industry’s transition toward unified terrestrial-satellite networks,” said John Schlaefer, CEO of the company.

“By combining our advanced 5G semiconductor solutions with the global satellite footprint, we’re enabling a new era of always-on connectivity that is more robust, more flexible, and more accessible than ever before,” Schlaefer added.

How Did Stocktwits Users React?

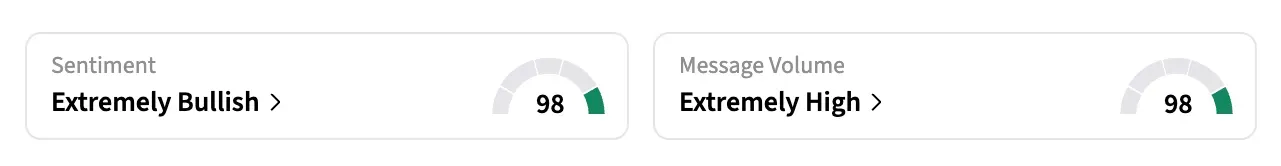

On Stocktwits, retail sentiment around GCTS shares jumped from ‘bullish’ to ‘extremely bullish’ over the past 24 hours. Meanwhile, message volumes rose from ‘high’ to ‘extremely high’ levels.

One bullish user speculated whether the partner may be Starlink.

Another user said the stock would go up to $2 today and hit $10 in February. GCTS shares were trading at $1.36 levels at the time of writing.

GCTS stock has declined more than 41% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Also Read: GRRR Stock Captures Street And Retail Attention — Here’s Why