Indian markets faced significant selling pressure this week, with benchmark indices posting sharp declines amid global uncertainties. The volatility index spiked 24% as the investors adopted a risk-averse approach ahead of the upcoming Union Budget.

Renewed fears of a US trade war, including Trump’s policy on Greenland and the potential tariffs on Europe, sparked a global risk-off sentiment and foreign institutional investor (FII) outflows. A weakening rupee also accelerated the sell-off, pushing India VIX higher.

NIFTY50 index fell 2.5% to 25,048, extending its downward trend following a doji pattern the previous week. The Sensex dropped by over 2.4% to 81,537, marking its second-largest weekly loss in January 2026.

Meanwhile, the NIFTY Midcap 150 and Smallcap 250 indices underperformed sharply. The NIFTY Midcap 150 index dropped 4.4% to 21,008, while the Smallcap 250 index slipped 5.5% to 15,314, reflecting heightened selling in riskier segments.

Spotlight: Depsite the border market weakness, the NIFTY Metal index hit a fresh all-time high. The sharp jump in the metal pack was due to silver futures surging to a fresh record high near $103 per troy ounce this week, up over 14% last week amid heightened geopolitical tensions, a softening US dollar. This precious metals rally provided a key tailwind for Indian metal stocks, boosting sentiment in silver-linked names and broader base metals. Among the whole metal pack, Hindustan Zinc (+9.6%), APL Apollo Tubes (+3.1%) and National Aluminium (+2.5%) were the top gainers.

️Key events in focus: On Wednesday, the Federal Open Market Committee will announce its monetary policy decision. Anticipation for this FOMC meeting is muted, as the central bank is widely expected to keep the federal funds rate unchanged. However, Wall Street will be focusing on the press conference from Jerome Powell in his final months as Fed Chair for clues as to how long the Federal Reserve intends to keep rates on hold.

Earnings blitz: So far this earnings season, corporate results have been decent. As we move forward, the earnings season will be in full swing. Companies releasing their Q3 FY26 results next week are Axis Bank, Asian Paints, ACC, Bharat Electronics, Larsen & Toubro, Maruti Suzuki, ITC, Tata Motors, Voltas, Bajaj Auto, Nestlé India, NTPC and Sun Pharma.

Meanwhile, in the United States, Meta Platforms, Microsoft and Tesla will announce fourth quarter earnings on Wednesday. Apple, Mastercard and Visa will announce their earnings on Thursday, while the week will close with reports from the oil giants Chevron and Exxon Mobil on Friday.

Mark your calendars: The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) will remain closed on 26 January on account of Republic Day.

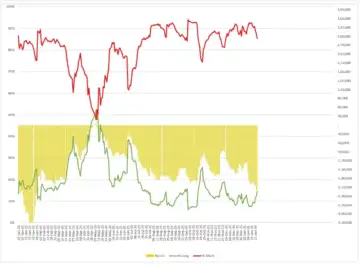

Market breadth

NIFTY’s market breadth weakened considerably this week, with the percentage of NIFTY50 stocks trading above their 50-day moving average fell sharply from the 50-55% range to the low 40s. This decline suggests that a greater proportion of stocks have fallen below key short-term trends, indicating a loss of momentum. While this does not indicate an oversold region, it does suggest rising vulnerability. This implies that the market may be entering a consolidation or corrective phase unless market breadth stabilises and recovers in the near future.

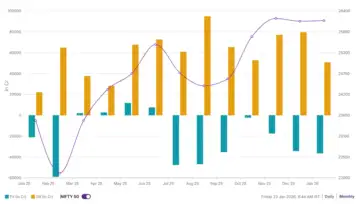

FIIs cash market and derivatives

This week, the Foreign Institutional investors (FIIs) sustained bearish stance and gradually covered their short contracts. Ahead of the rollover for the February series, the long-to-short ratio stands at 86:14, down from 91:9 of last week. However, the net open interest still remains negative, indicating that the broader positioning still remains bearish.

In the cash market, the FIIs have remained net sellers for the entire January. They have offloaded shares worth ₹36,591 crore in January, higher than last four months. On the flip side, the Domestic Investors remained net buyers and supported the market by buying shares worth 54,822 crore.

NIFTY50 outlook

Charts suggest that the final phase of short-term weakness may still be unfolding, with NIFTY50 likely to enter a crucial support zone of 24,800. In the short term, the index could see a widening of the range as volatility remains high. Due to the higher implied volatility, option-buying strategies have an unfavourable risk-reward ratio and should be avoided ahead of the Union Budget. Unless the Budget delivers a clear positive surprise, the broader positioning remains weak with rallies facing selling pressure on rebound.