Under a new partnership, WBD’s HBO Max will feature K content from production house CJ ENM and its streaming site TVING.

Warner Bros. Discovery is making a major push into Korean content as part of its strategy to strengthen HBO Max’s position and expand its audience base across Asia.

The media conglomerate on Thursday announced a content production and distribution partnership with TVING, a streaming service operated by South Korea’s largest production house, CJ ENM. WBD shares rose 1% in extended trading.

Under the pact, HBO Max will exclusively host CJ ENM’s and TVING’s new K-drama titles, alongside their existing libraries of shows and content, from early next year.

The companies will also co-invest and co-produce original Korean dramas for global distribution on HBO Max.

The move is the latest amid Warner Bros.’ aggressive push to expand HBO Max in Asian markets, where streaming growth has stayed strong despite softness in certain Western regions. On Wednesday, the service launched in 14 Asia-Pacific countries, including Bangladesh, Cambodia, Pakistan, and Sri Lanka.

“K-content captivates audiences everywhere with its creativity and originality,” said Miky Lee, vice chairwoman of CJ Group. “Together, we will deliver authentic narratives that transcend borders on a platform where fans can discover new favorites, revisit timeless classics and experience the best in global content.”

K-dramas, such as the hugely popular “Squid Game” and “Queen of Tears,” have drawn millions of viewers worldwide in recent years and are also popular on streaming services like Disney+ and Netflix.

What Stocktwits Users Are Saying About WBD

Meanwhile, several larger catalysts are at play for the stock. WBD is demerging Warner Bros and Discovery, dividing its streaming and studios units from cable TV operations into two publicly listed companies by mid next year.

More recently, the company was approached by Paramount Skydance for an acquisition. WBD reportedly rejected the $20-per-share bid last weekend, although David Ellison-owned Paramount may return with a stronger offer.

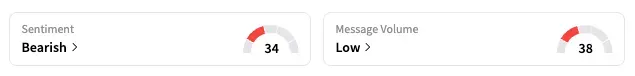

On Stocktwits, the retail sentiment for the stock was ‘bearish,’ unchanged over the week, with ‘low’ message volume. The acquisition bid updates were the key focus for retail watchers, according to their comments.

“I agree that something is in the works. Maybe not today, but I think we might hear at least some more deal chatter this week,” said one user.

As of the last close, WBD stock is up 75% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<