Maxim boosted its price target for the stock to $15 from $10, citing impressive revenue and adjusted EBITDA performance in the first half.

Rezolve AI (RZLV) is drawing strong attention from Wall Street, with multiple analysts raising their price targets following a strong first-half (H1) earnings.

The company reported a 426% year-over-year (YoY) increase in revenue to $6.3 million for H1 2025, which exceeded the $5.25 million forecasted by analysts, according to Fiscal AI data. Additionally, Rezolve raised its 2025 annual recurring revenue (ARR) outlook to $150 million.

Maxim boosted its price target on the stock to $15 from $10 and maintained a ‘Buy’ rating, citing impressive revenue and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) performance in H1 and growing confidence in the firm’s ability to monetize strategic partnerships, according to TheFly.

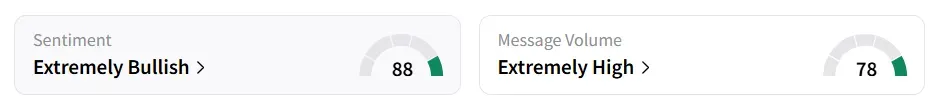

Rezolve AI stock traded over 15% higher on Thursday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock saw a 117% surge in user message count over 24 hours as of Thursday morning. A bullish Stocktwits user backed Maxim’s price target of $15.

Roth Capital raised its target to $12.50 from $9 and reiterated a ‘Buy’ rating, projecting that Rezolve could reach $150 million in annual recurring revenue (ARR) by the end of 2025 and scale further to $500 million in 2026 through acquisitions and upsells.

Cantor Fitzgerald also lifted its target to $7 from $5 and upheld an ‘Overweight’ rating, noting volatility amid a recent short‑seller report but emphasizing Rezolve’s ability to deliver value superior to generic large language models.

Rezolve AI stock has gained over 56% in 2025 and has lost over 12% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<