Company-specific catalysts, including earnings news and changes in index constituents, led to heightened activity in some stocks in Wednesday’s after-hours session.

U.S. stocks shrugged off the early indecision seen on Wednesday, following the release of mixed economic data, and ended higher. The S&P 500 Index picked up enough momentum to close at a new record. The see-sawing mood will likely continue in the coming sessions, at least until the release of the August non-farm payrolls report.

Company-specific catalysts, including earnings news and changes in index constituents, led to heightened activity in the following stocks in the after-hours session.

Walgreens Boots Alliance, Inc. (WBA)

After-hours move: +0.50%

Trading volume: 93.18 million

The substantial after-hours volume in Walgreens Boots Alliance stock occurred as the company is set to be removed from the S&P 500 Index, effective before the market opens on Thursday, following the retail pharmacy chain’s agreement to be taken private by Sycamore Partners in a deal valued at $23.7 billion.

WBA shareholders will receive total consideration consisting of $11.45 per share in cash at closing of the Sycamore transaction and one non-transferable right to receive up to $3 in cash per WBA share from the future monetization of WBA’s debt and equity interests in VillageMD.

The stock was halted for trading after the close of trading on Wednesday, and will remain suspended until it is delisted.

On Stocktwits, retail sentiment toward WBA stock remained ‘bullish’ (75/100) by late Wednesday, and the message volume on the stream was ‘extremely high.’

The stock has gained 28.40% year-to-date (YTD).

Interactive Brokers Group, Inc. (IBKR)

After-hours move: +0.10%

Trading volume: 60.76 million

Shares of Interactive Brokers gained steam as they are set to be added to the S&P 500 Index ahead of Thursday’s market open, replacing WBA in the broader gauge.

Interactive Brokers’ stock rose 0.9% on Thursday after S&P Dow Jones Indices’ announcement in this regard, but fell over 2% on Wednesday.

Retail sentiment toward the stock remained ‘extremely bullish’ (92/100) among Stocktwits users, with the message volume at ‘extremely high’ levels.

YTD, Interactive Brokers’ stock has soared over 40%.

Nvidia Corp. (NVDA)

After-hours move: -3.10%

Trading volume: 59.72 million

Nvidia’s stock remained on investors’ radar after the artificial intelligence (AI) chip giant reported forecast-beating results for the second quarter of fiscal year 2026. The stock, however, slid more than 3% in after-hours trading as investors expressed disappointment over the slight data center sales miss and the deceleration in sales growth the company forecasted for the third quarter.

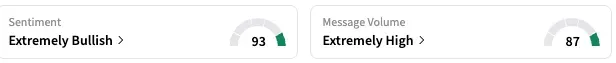

Retail traders’ optimism abounded, with the sentiment meter on Stocktwits reading 93/100, suggesting an ‘extremely bullish’ mood, up from the ‘bullish’ sentiment seen a day ago. The message volume also picked up pace to ‘extremely high’ levels.

Nvidia’s stock is up 35.25% this year.

Lucid Group, Inc. (LCID)

After-hours move: unchanged

Trading volume: 13.89 million

The increased interest in luxury electric-vehicle (EV) maker Lucid’s stock comes as a 1-for-10 reverse stock split announced by the company takes effect on Friday. The stock will begin trading on a reverse split-adjusted basis on Tuesday.

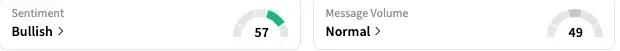

On Stocktwits, retail sentiment toward the stock remained ‘bullish’ (57/100) and the message volume was ‘normal.’

The stock has declined by more than 31% this year, amid worsening EV market fundamentals and the company’s production woes.

Intel Corp. (INTC)

After-hours move: -0.38%

Trading volume: 8.57 million

Shares of Intel resumed their climb on Wednesday, snapping a two-day losing streak, as investors remained interested in the stock amid the U.S. government’s move to invest in the company.

Intel stock elicited ‘bullish’ sentiment (69/100) from among retailers on the Stocktwits platform, with the buoyant mood accompanied by ‘high’ message volume.

YTD, the chipmaker’s stock has added nearly 24%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.