The Executive SUV segment sits above the midsize SUV category – both in terms of size and pricing – and is currently dominated by Mahindra, with the XUV700 and Scorpio N leading the charge.

Other notable contenders include the Tata Harrier and Safari, MG Hector and Hector Plus, Jeep Compass, Hyundai Alcazar and Tucson, Citroën C5 Aircross, and Volkswagen Tiguan.

While several of these models are relatively new, even the more established nameplates – many over five years old – have seen major updates to meet evolving consumer expectations.

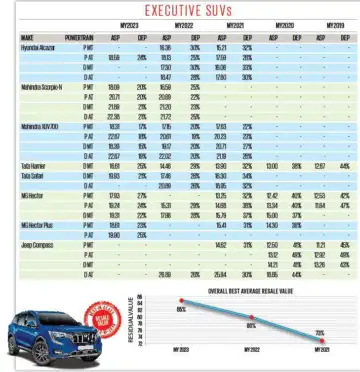

Used executive SUV resale value study results

Interestingly, diesel versions hold their value better than their petrol counterparts.

Mahindra’s offerings, particularly the XUV700 and Scorpio N, enjoy consistently strong demand in the new car market, which directly contributes to their solid resale values. Both models exhibit slow depreciation, with the diesel-manual XUV700 leading the pack in value retention, followed closely by its petrol-manual counterpart – both showcasing remarkably flat depreciation curves.

In contrast, Tata’s diesel-only Safari and Harrier depreciate more rapidly. A similar pattern is observed with the Hyundai Alcazar, although its petrol-automatic variant bucks the trend by registering the lowest average depreciation within its lineup. Between the MG Hector and the Hector Plus, the latter retains its value slightly better – likely due to its more versatile three-row seating configuration.

The Jeep Compass received a major update in 2021, but limited demand in the new car market has resulted in few used units, making value assessment difficult. However, the pre-facelift Compass showed the steepest depreciation in the segment.

Due to insufficient transaction data, resale trends for the Hyundai Tucson, Citroën C5 Aircross, and Volkswagen Tiguan have not been included in this analysis.

Autocar India-Spinny Resale Value Study

This finding is based on a joint study conducted by Autocar India in collaboration with Spinny, a leading used car platform operational in 22 cities across India, including Delhi, Gurugram, Noida, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, Ahmedabad, Lucknow, Jaipur, Chandigarh, and Indore. Spinny provided average selling prices (ASP) derived from actual transactions of 21,944 cars sold across its network during the 2024 calendar year. For the purpose of the study, if a particular model had multiple engine options of the same fuel type, or came in multiple variants, these were merged and averaged. Depreciation was calculated as the percentage difference between a car’s on-road price in its year of manufacture and its resale price in 2024.