A new report from Bitwise showed that crypto adoption reached record levels in both personal and client portfolios for financial advisors heading into 2026.

- Bitwise’s report showed that financial advisors are bullish on Bitcoin, Ethereum, and Solana, anticipating at least a 15% upside for each asset.

- Most client allocations remain below 5%, though positions are growing in size.

- In 2025, 32% of financial advisors said they had allocated cryptocurrency on behalf of clients, up from 22% in 2024.

Financial advisors are continuing to expand cryptocurrency exposure across client portfolios heading into 2026, with growing conviction around Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), according to a new survey from Bitwise.

The analysis firm noted that advisors are allocating crypto to client portfolios at a record pace. In 2025, 32% of respondents said they had allocated cryptocurrency on behalf of clients, up from 22% in 2024. Bitwise said the increase showcases crypto’s expanding role within portfolio construction, rather than being a fringe asset.

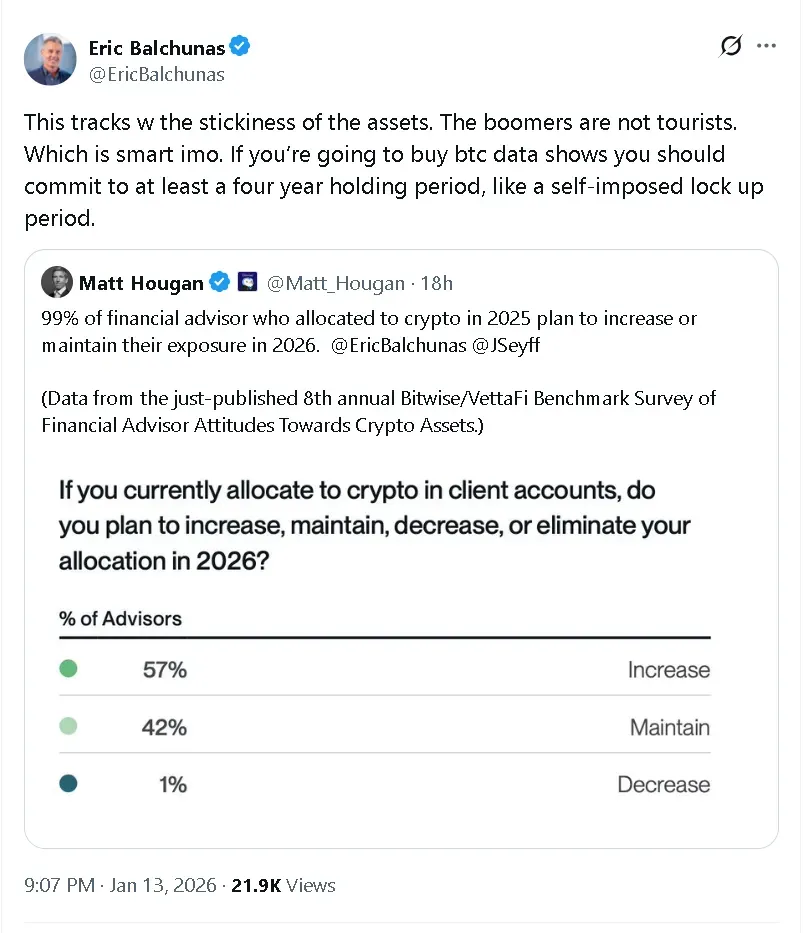

In a post on X, Bloomberg analyst Eric Balchanas said it’s a “smart” move because if one buys Bitcoin, they should be prepared to hold for at least four years. “Like a self-imposed lock-up period,” he wrote.

While financial advisors are increasing exposure to crypto assets, their top concerns are volatility and regulatory bottlenecks. In 2025, macroeconomic concerns about tariffs and an AI bubble weighed on the crypto market.

Crypto Isn’t Just For Clients

The report showed that financial advisors are also adding more crypto to their personal portfolios, with more than half of the respondents owning crypto assets. Bitwise said that represents the highest level of personal ownership since the firm began tracking advisor sentiment in 2018, surpassing the prior high of 49% recorded last year.

Bullish On Bitcoin, Ethereum, And Solana

The increase in allocation stems, in part, from the bullish sentiment behind Bitcoin, Ethereum, and Solana. More than half of the respondents said they expect Bitcoin’s price to be higher one year after the survey’s launch, when Bitcoin was trading near $110,000. While the target figure is 12.5% below BTC’s record high of over 126,000 seen in October, it implies a potential upside of 15% from Bitcoin’s current price of around $95,100.

On Stocktwits, retail sentiment around the apex cryptocurrency flipped to ‘bullish’ from ‘bearish’ territory over the past day, while chatter remained at ‘normal’ levels.

Ethereum is also expected to rally, with 62% of advisors expecting higher prices from levels near $3,900. This implies an upside of around 18% from Ethereum’s current price of around $3,300. Retail sentiment around the leading altcoin improved to ‘bearish’ from ‘extremely bearish’ over the past day as chatter rose to ‘normal’ from ‘low’ levels.

The most bullish forecast was for Solana, with most respondents expecting it to cross $180 this year – a 25% jump from SOL’s current price of around $144. Retail sentiment around the token also improved over the past day to ‘bearish’ from ‘extremely bearish’ territory.

Crypto Allocation Strategy

The survey results showed that, among portfolios with crypto exposure, most held allocations below 5% of total assets. Within that bucket, 64% of portfolios had allocations over 2%, up from 51% in 2024.

Bitwise said the numbers suggest crypto’s gaining weight within diversified portfolios even if it’s not a mainstream asset yet.

Read also: Tom Lee-Backed BMNR Stakes Over A Quarter Of Its Ethereum Treasury Ahead Of Shareholder Vote

For updates and corrections, email newsroom[at]stocktwits[dot]com.<