Amid this cacophony of startup IPOs, all eyes are on Urban Company’ public listing, which has grabbed the spotlight not only as one of the most subscribed public issues but also the hottest one of 2025 so far.

With an oversubscription of nearly 104X, with strong demand across institutional, HNI, and retail investors alike, the company is set to list on the bourses this week (September 17).

Undoubtedly, the unicorn has thrown a record-breaking IPO when compared to the likes of Zomato, Nykaa and other trailblazers.

For context, Nykaa’s IPO was oversubscribed 82X and Zomato 38X – impressive, but still eclipsed by Urban Company’s IPO frenzy, despite the latter being late entrant in the great Indian startup IPO race.

So, why did Urban Company’s IPO become such a big deal? Let’s find out…

What Explains The Urban Company IPO Frenzy?

“This is the first established startup of its kind going public, and there isn’t really a listed competitor to compare it with. That’s one reason for the craze,” said Kush Ghodasara, managing partner at InvestValue.

The buzz around Urban Company was visible even before bidding began. Its grey market premium climbed over 30% ahead of its IPO, and the icing on the cake was its IPO price band of INR 98 to INR 103 per share.

The company’s stock was trading at a premium of up to 45% in the informal market on Friday. This led to predictions running amok among analysts that the consumer tech company could list at a premium of 40-44% on the Indian exchanges.

“However, much of this surge may be speculative froth, amplified by limited float and the scarcity premium attached to consumer tech issues. Sustaining those gains will depend on earnings visibility and execution,” added Sourav Choudhary, MD of Raghunath Capital.

To put things in context, Urban Company’s IPO reserved at least 75% of the shares in the public issue for qualified institutional buyers (QIBs), up to 15% for non-institutional investors (NIIs), and no more than 10% for retail investors.

Another key variable that worked in favour of the company has been its dominant position in the country’s organised at-home services space.

Market analysts also point out that investors could also be reading into Urban Company’s turnaround to profitability in FY25. While the headline numbers come with some caveats, the idea of a “profitable tech platform” hitting the public markets is undeniably compelling.

Can Profitability Stand The Test Of Time?

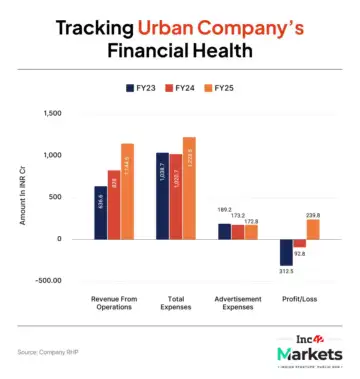

Until FY24, Urban Company was still in the red – posting losses of INR 92.7 Cr in FY24 and INR 312.5 Cr in FY23. While operating revenue jumped 38% year-on-year (YoY) to INR 1,144.5 Cr in FY24, the company had just fallen short of profits.

Profitability finally came in FY25 and by Q1 FY26, the company’s profit had touched INR 6.9 Cr, even as operating revenue rose 24% YoY to INR 367.3 Cr. But market analysts are cautious as they see cracks underneath the glossy turnaround story.

“Yes, they’ve turned profitable this year, which is a positive sign. However, there’s a risk that the timing of this turnaround is too convenient, just ahead of the IPO. On average, the company has been loss-making over the last three years, which is a concern,” an analyst said on the condition of anonymity.

Another red flag, as per experts, is its aggressive expansion spree, which calls for heavy investments.

“No one knows whether these new services will pay off. Still, given the company’s strong brand and past trajectory, investors may stay hopeful for at least two to three quarters to see how things play out,” the analyst quoted above added.

This will have its ripples.

Even if Urban Company lists at a premium, the stock is likely to see some drop in the next few quarters and will be tested as its results come.

“It may open with a premium depending on market conditions. These days, IPO stocks usually perform for a day or two, but the real test comes after two weeks of trading – when the hype settles. That’s why long-term investors must wait for at least one quarterly result before entering,” Ghodasara said.

From Listing Buzz To Long-Term Reality

Urban Company’s IPO has surely created some buzz in the market. However, analysts advise investors to cut through the noise, as the real test for the company will be to sustain its early gains. “This will depend squarely on earnings visibility and execution,” analysts said.

On paper, the story looks lucrative – a strong brand recall, a financial turnaround, and the first-mover advantage in India’s highly organised home-services sector.

But, there are caveats.

“High valuations leave little margin for error. Intense competition from offline service providers and quick commerce platforms poses a threat. Execution challenges around quality, retention, and dispute resolution remain. Regulatory changes concerning the rights of gig workers could also elevate compliance costs,” added Hariprasad K, the founder of Livelong Wealth, a stock market training institute.

Post-IPO, three factors will need close tracking – demand swings in discretionary services, regulatory scrutiny, and the challenge of scaling overseas.

“Any of these could weigh on margins and valuations if not carefully managed,” Raghunath Capital’s Choudhary said.

As for investors, the Urban Company IPO was a high-risk, high-reward bet, suitable only for those with a long-term horizon who believe in the company’s ability to scale sustainably as online penetration deepens. However, there are fears that Urban Company’s D-Street craze may wear off as it braces for the real test.

Markets Watch: Upcoming Issues, Results & More

The premium fashion startup has secured board approval to raise up to INR 750 Cr via fresh issue through its IPO. With strong revenue growth and global ambitions, the luxury brand is gearing up for a 2026 listing.

The edtech unicorn has refiled its draft IPO papers with SEBI for a INR 3,820 Cr public listing. Backed by strong revenue growth and an expanding hybrid model, can PW wipe off the Indian edtech blot with a blockbuster IPO?

DevX’s IPO saw massive investor interest, closing at a 63.97X oversubscription. Retail investors led the charge at 164.72X, while NIIs and QIBs also showed a strong appetite, signalling huge confidence in the startup’s growth.

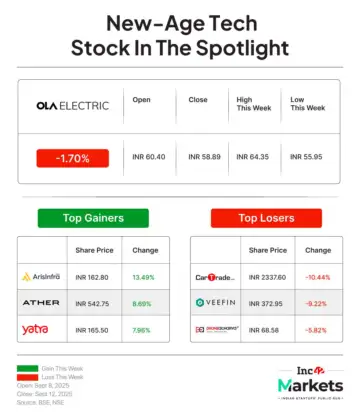

The brokerage firm has downgraded the listed car reselling platform to ‘Sell’ from ‘Hold’. The brokerage cited a mix of valuation concerns, reliance on cyclical B2B revenues, and growing competitive pressures from GenAI tools as the reasons behind its move.