The upcoming Union Budget is set to prioritise economic stability and fiscal prudence. Crisil’s Chief Economist notes a favourable growth and inflation scenario but warns of global volatility, urging caution and the need for key trade deals.

The upcoming Union Budget is expected to prioritise economic stability and fiscal prudence following a year of higher-than-expected growth and lower inflation.

Favourable Economic Outlook with a Note of Caution

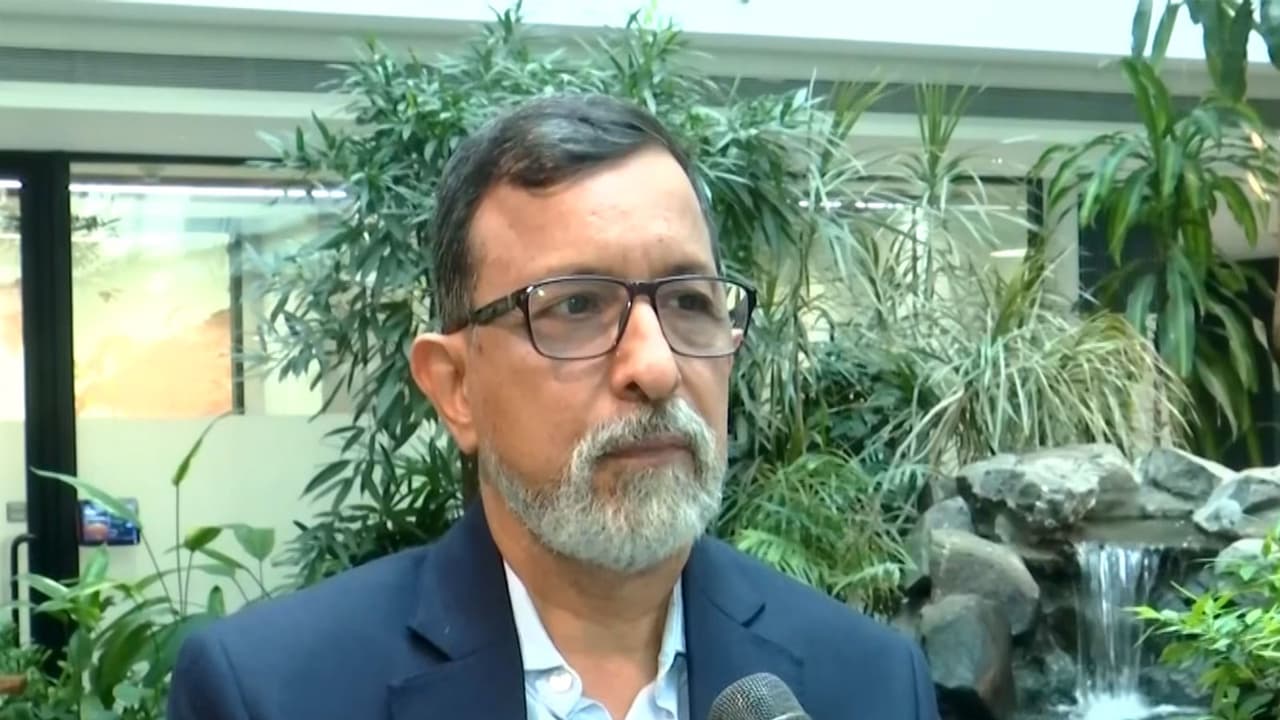

Dharmakirti Joshi, Chief Economist at Crisil, stated that the budget is being prepared under a favourable growth and inflation scenario, though global uncertainty and volatility remain key considerations for the government. “Well, first of all, the budget is being prepared under a much better-than-expected growth and inflation scenario. Growth proved to be higher than expected, and the inflation was much lower than expected,” Joshi said while speaking to ANI.

He noted that the budget will have to ensure that public finances remain in good shape to maintain economic stability. A significant benefit for the 2026-27 fiscal year is the expectation of a higher nominal GDP than in the previous year. According to Joshi, a higher nominal GDP will lead to better tax collections and improved corporate performance. However, he cautioned that “it’s a very, very uncertain and volatile scenario” and the government will need to maintain fiscal prudence.

The government has upgraded the GDP forecast for FY 2025-26 to approximately 7.3-7.4 per cent, up from the previous estimate of 6.3 per cent, a move mirrored by the IMF. Joshi mentioned that while real growth provided a positive surprise, the economy is expected to grow around 6.7 per cent next year. He added that a re-basing of GDP data scheduled for February 27 could further revise perceptions of the economy’s size and speed.

Focus on International Trade Deals

Addressing international trade, Joshi emphasised the importance of securing trade deals with the United States and the European Union to provide exporters with certainty. He highlighted that India faces some of the highest tariffs globally, and the full impact of these tariffs may be felt if a deal with the US is not reached. “It’s important that I think we get a deal with the US, and a deal with Europe will also be very encouraging because Europe is a very large continent,” Joshi remarked.

Fiscal Discipline and Investment Climate

On the fiscal front, the central government is likely to meet its targets, though state deficits remain a concern. Joshi pointed out that states are borrowing more than budgeted, which keeps government bond yields high. He also noted that while private capital expenditure is improving in sectors like steel, cement, and oil and gas, it is not yet a “broad-based animal spirits driven revival.”

Future Allocations and Tax Reforms

Looking ahead to the budget allocations, Joshi expects a continued push for reforms aligned with the ‘Viksit Bharat by 2047’ target. He suggested that the government might focus on incentivising newer segments such as electronics and ACC batteries. Regarding taxation, he stated that frequent changes are undesirable and noted that “the income taxes have got, I think there’s a new code coming, the tax rates have been rationalized and also GST rates have come down.”

(ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)