Inclusion in such sub-indexes boosts a stock’s visibility and credibility, and often lifts its price.

Uber stock, which recently hit a record high, is in the spotlight again. The ride-hailing firm’s shares were included in the S&P 100 index on Monday, replacing those of Charter Communications.

Shares rose 0.3% in early premarket trading on Tuesday.

The inclusion in such sub-sets boosts a stock’s visibility and credibility, often driving higher demand as index funds and ETFs tracking the benchmark are required to buy it. It typically also lifts the share price.

Uber shares are on a tear, rising 65% already this year, as return-to-office mandates at more workplaces and new Uber products drive strength in the underlying business.

The stock has gained 7% in the last three sessions alone, and if the momentum continues, it could test the psychological $100 level for the first time.

Retail traders were already posting congratulatory messages on Stocktwits.

“$UBER I can’t believe my eyes! Been holding and accumulating for over 4 years, long time coming. Congrats bulls,” said one user.

Another user said, “All the new tech with ev, av, drones, ai, advertising, and logistics directly helps this business,” forecasting the company to one day achieve a $1 trillion market cap.

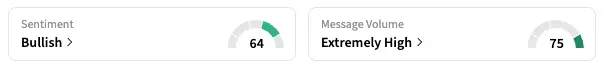

The retail sentiment for UBER’s stock remained ‘bullish,’ unchanged over the past week.

Currently, 42 of the 54 analysts covering Uber have a ‘Buy’ or higher rating on its shares, while 12 recommend ‘Hold,’ according to Koyfin data. Their average price target is $106.63, implying a 7.3% upside from the last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<