UAMY stock tanked 11% on Monday after Korea Zinc announced plans to invest $7.4 billion to build a new smelter in the U.S to produce strategic minerals.

- UAMY stock rebounded from its 200-DMA in July this year; the last time it fell below the line was in July 2024.

- The company’s Q3 net loss widened significantly to $4.8 million, and it narrowed its FY2025 revenue guidance.

- In October, Australia’s Larvotto Resources had rejected a buyout offer from UAMY.

United States Antimony Corp. (UAMY) stock fell 3% on Tuesday and is trading close to its 200-day moving average (200-DMA) for the first time since the beginning of July.

The last time UAMY fell below the 200-DMA line was in July 2024. The stock has been on a steady decline after it reached a high of $19.7 in October, falling around 75%.

Q3 Results Snapshot

In November, UAMY reported revenues of $8.7 million for the third quarter of 2025, a 238% increase from $2.6% million in the same period of 2024. Operating expenses surged to $6.93 million.

However, net loss widened significantly to $4.8 million, compared with a loss of $729,384 in the prior-year period. The company also narrowed its full-year 2025 revenue guidance to $40-$43 million and reaffirmed its 2026 target of $125 million.

Key Developments In 2025

In October, Australia’s Larvotto Resources rejected a buyout offer from UAMY, citing concerns that the proposed deal undervalued the company. UAMY had offered A$1.40 ($0.9) per share to acquire the remaining Larvotto shares it did not already own, having disclosed a 10% stake in the Australian miner before the offer.

UAMY was pursuing the deal to expand its antimony production amid rising global demand, particularly given China’s export restrictions.

In September, the American miner had secured a five-year, $245 million contract with the U.S. Defense Logistics Agency to supply antimony metal ingots for the defense stockpile.

Korea Zinc’s U.S. Investment

UAMY stock tanked 11% on Monday after Korea Zinc announced plans to invest $7.4 billion to build a new smelter in the U.S to produce key metals and strategic minerals. The company said the U.S. government requested the project to help address rising supply-chain risks and growing domestic demand for non-ferrous metals.

The facility will produce zinc, lead, and copper, as well as gold, silver, and strategic minerals, including antimony, germanium, and gallium.

Construction is expected to begin in 2027, with commercial operations ramping up through 2029.

How Did Stocktwits Users React?

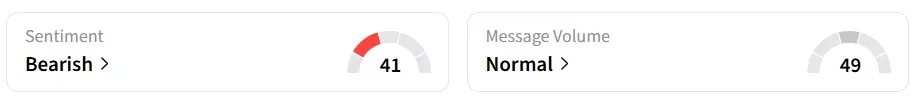

Retail sentiment for UAMY on Stocktwits has remained in the ‘bearish’ territory for the past 24 hours.

One user explained why Korea Zinc’s investment will not deter UAMY’s operations.

Another user remains bullish on the stock, citing upcoming ‘catalysts’.

The stock has a target price of $9.67, according to Koyfin data. Year-to-date, UAMY has gained 173%.

Read also: This Stock Crashed 35% Just Days After Posting An 18,000% Revenue Jump – What Triggered The Sell-Off?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<