The Indian stock market has been grappling with global headwinds, with benchmark indices Sensex and Nifty 50 delivering no returns over the past year.

Concerns around weak corporate earnings, stretched valuations, and persistent foreign capital outflows have kept investor sentiment subdued.

Adding to the uncertainty, US President Donald Trump has doubled tariffs on Indian imports to as much as 50%, effective August 2025. This includes a 25% reciprocal tariff linked to India’s Russian oil purchases, on top of the earlier 25% tariff imposed on several imports. The higher duties have hit India’s export-oriented sectors, with IT, textiles, gems and jewellery, and seafood particularly vulnerable.

The challenges intensified after Trump announced a steep $100,000 annual fee on H-1B visas, effective September 21, 2025. From the next visa lottery cycle, all new H-1B filings will attract the fee, significantly increasing the cost of onsite deployment for Indian IT firms, which account for nearly 70% of H-1B visa holders.

IT Sector Under Pressure

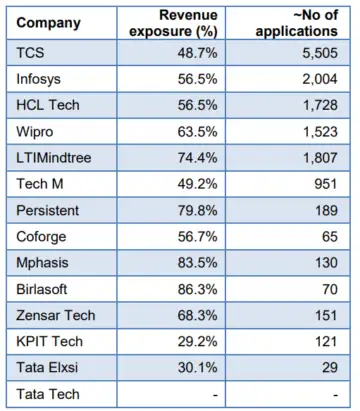

Indian IT services companies derive the majority of their revenues from the US market, making them the most exposed to these changes. According to Nirmal Bang Institutional Equities Research, firms like Birlasoft (86.3% of revenues from the US), Mphasis (83.5%), Persistent Systems (79.8%), and LTIMindtree (74.4%) have the highest dependence on the US. Meanwhile, Tata Consultancy Services (TCS) leads in H-1B applications, followed by Infosys, HCL Technologies, and Wipro.

“The H-1B fee hike doesn’t just impact IT companies’ cost structures – it changes aspirations across disciplines. More young Indians may seek alternate destinations for education and careers, with consequences beyond sectoral earnings,” said Mohit Gulati, CIO and Managing Partner, ITI Growth Opportunities Fund.

Analysts, however, caution against overstating the disruption. The IT sector has been gradually adapting through increased offshore delivery, near-shore centers, and local hiring in the US.

“The old model of rotating engineers onsite is giving way to a mix of offshore delivery, near-shore centers, and deeper local hiring in America. For investors, that means not every IT stock will move the same way. The winners will be the firms that can rewire their operating model quickly, absorb cost shocks, and still deliver client outcomes at scale. The losers will be those that stay tied to an older playbook,” said Viram Shah, Founder & CEO, Vested Finance.

Tariff Impact Beyond IT

The higher US tariffs also weigh heavily on India’s traditional export sectors. Textiles, gems and jewellery, and seafood exporters are particularly vulnerable. The US is the largest market for Indian gems and jewellery, accounting for nearly one-third of annual exports worth $28.5 billion. Shrimp exporters, who send over half their output to the US, face the risk of steep order cancellations.

India’s competitiveness may further erode compared with regional peers, as tariffs on Indian goods are higher than those imposed on other Asian countries such as China (30%), Vietnam (20%), Indonesia (19%), and Japan (15%).

Market Strategy

Despite near-term headwinds, analysts advise against panic selling of IT stocks. “Patience with well-managed companies that have strong balance sheets can be rewarding. If exposure is high, partial profit-booking may be considered while maintaining diversification,” said Puneet Singhania, Director, Master Trust Group.

For new investors, a cautious wait-and-watch approach is recommended. Long-term structural themes such as cloud, digital, and AI adoption remain intact, which could provide attractive entry points once valuations turn more favourable.

“Gradual accumulation and spreading investments will allow investors to participate in the sector’s eventual recovery while limiting downside risk,” Singhania added.

Outlook

The market mood remains sombre as Commerce Minister Piyush Goyal engages in trade talks in Washington. A breakthrough in the India-US trade deal could provide some relief, but until then, investors will continue to weigh protectionist risks against the sector’s long-term growth potential.