President Trump also added that the next attack by the U.S. on Iran will be “far worse,” while referring to the “Operation Midnight Hammer” that was carried out in June 2025.

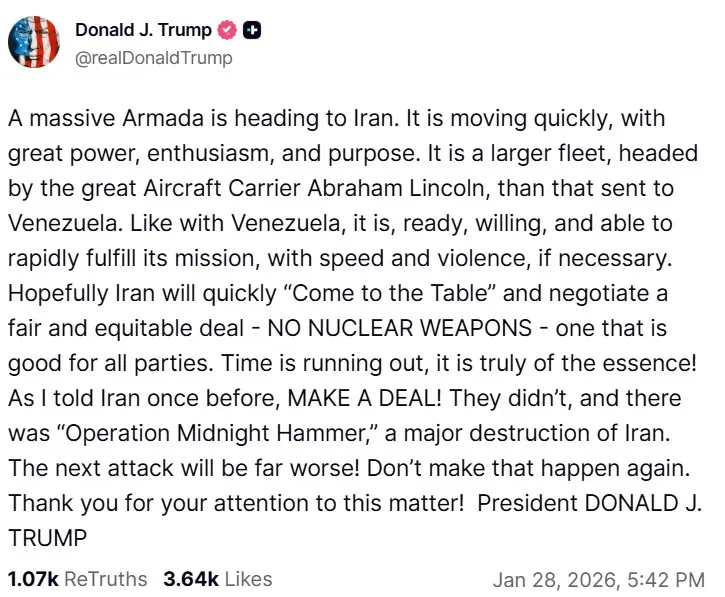

President Donald Trump on Wednesday announced that a “massive armada” is headed to Iran in the latest signs of tensions between the Middle Eastern country and the United States heating up.

“It is a larger fleet, headed by the great Aircraft Carrier Abraham Lincoln, than that sent to Venezuela. Like with Venezuela, it is, ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary,” said President Trump in a post on Truth Social.

He warned Iran that time is running out for the country to reach a nuclear weapons deal with the U.S. Trump also added that the next attack by the U.S. on Iran will be “far worse,” while referring to the “Operation Midnight Hammer” that was carried out in June 2025.

Trump’s latest warning to Iran has thrust geopolitical risk back in the spotlight. This comes as Wall Street gears up for heavy earnings, with several big technology companies, like Tesla Inc. (TSLA), Meta Platforms Inc. (META), Microsoft Corp. (MSFT), and Apple Inc. (AAPL) scheduled to announce their latest quarterly results this week.

The Federal Reserve is also slated to announce the outcome of the latest Federal Open Market Committee (FOMC) meeting on Wednesday.

Meanwhile, U.S. equities were mixed in Wednesday’s pre-market trade. Futures of the Dow Jones Industrial Average (DJIA) were down 34 points at the time of writing, while the S&P 500 gained 0.22%, and the Nasdaq 100 was up by 0.76%.

The SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, rose 0.28%, the Invesco QQQ Trust ETF (QQQ) rose 0.82%, and the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.06%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘extremely bearish’ territory.

Get updates to this story developing directly on Stocktwits.<

For updates and corrections, email newsroom[at]stocktwits[dot]com.<