Generic drugs remain exempt, while duties will apply to prescription, biologic, specialty and over-the-counter medicines.

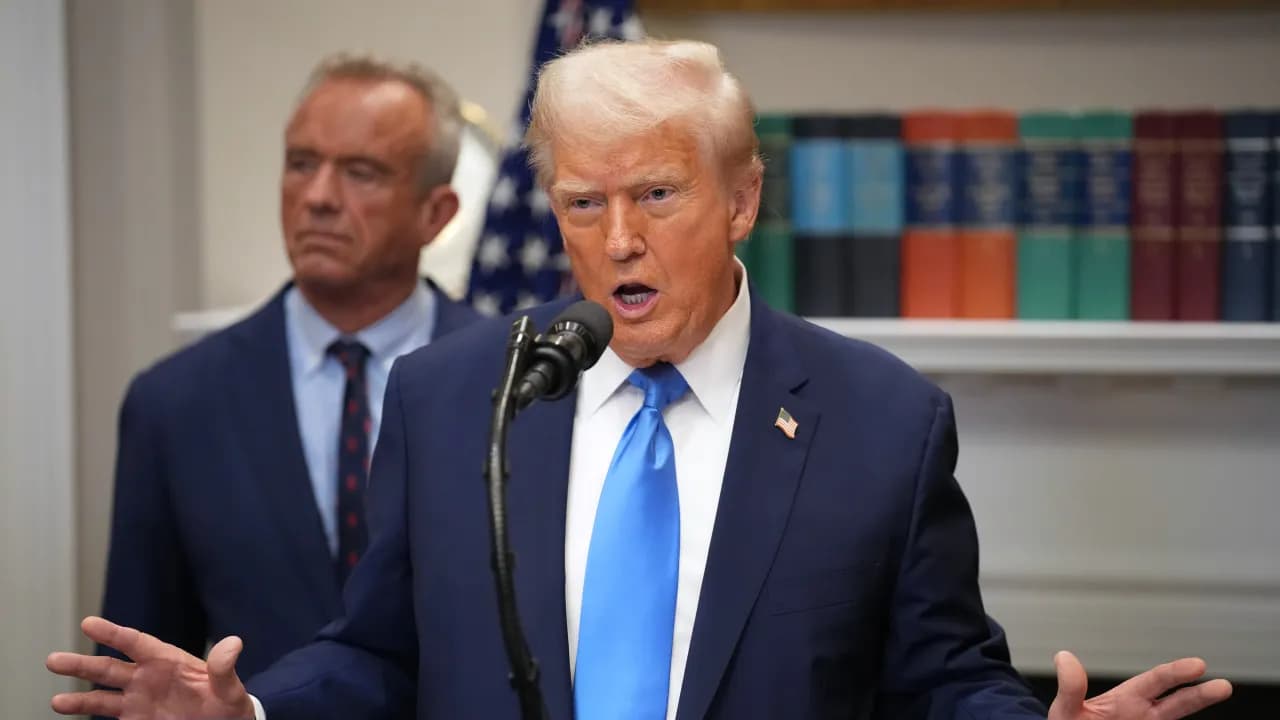

U.S. President Donald Trump said on Thursday that the United States will impose a 100% tariff on branded and patented pharmaceutical products starting Oct. 1 unless manufacturers are actively building plants in the country.

As part of a series of late-night posts on Truth Social on Thursday, Trump said the exemption will apply only to firms that have “broken ground” or are “under construction.” “There will, therefore, be no Tariff on these Pharmaceutical Products if construction has started.”

The announcement intensifies the administration’s push to shift drug manufacturing to the U.S. Last month, Trump said the U.S. would begin with a “small tariff” on imported drugs before raising duties to 150% within 18 months and ultimately to 250%.

Pharmaceuticals had previously been exempt from Trump’s reciprocal tariff program; however, the new duties will apply to prescription drugs, biologics, specialty medicines, and over-the-counter products, except for generic drugs, which remain excluded.

Major drugmakers have responded unevenly. Eli Lilly has committed more than $50 billion since 2020 to U.S. expansion, including $27 billion for four new “mega sites.” The company supports maintaining the U.S. as the “world’s leading destination for biopharmaceutical research and manufacturing” and agrees with the administration’s goal of more fairly sharing drug costs across developed countries, even as it warns that broad tariffs could raise costs and limit access.

Lilly’s stream on Stocktwits gained traction late Thursday after Trump’s announcement, with sentiment tilting ‘bullish’ as retail traders bet that the company would benefit from the latest federal policy. “$LLY did great with plant announcement in houston this week. They wont have tariffs,” said one user.

Several users noted that Novo Nordisk, Regeneron and Thermo Fisher also have U.S. sites that could qualify. Some argued investors misunderstand Novo’s footprint, contributing to its recent weakness despite likely exemptions.

AstraZeneca and Roche each announced plans this summer to invest $50 billion in new or expanded facilities across multiple states. Merck has invested more than $12 billion in U.S. manufacturing since 2017 and plans to invest an additional $9 billion by 2028, while Biogen has pledged $2 billion to upgrade its North Carolina plants.

Others have taken a more cautious stance. Pfizer stated in March that it could shift overseas production to existing U.S. sites if necessary, but has not committed to new investment, whereas Novo Nordisk has yet to announce major U.S. projects.

Trump’s Thursday night post followed the launch of fresh national security probes into imports of robotics, industrial machinery, and medical devices. The Commerce Department said on Wednesday that it launched investigations on Sept. 2 to determine if these imports could pose a risk to U.S. national security.

On Stocktwits, retail sentiment for the SPDR S&P Biotech ETF (XBI) was ‘bearish’ amid ‘normal’ message volume.

XBI has risen 6.5%. So far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<