In an interview with CNBC, the U.S. Treasury Secretary also reiterated that President Donald Trump feels that the Federal Reserve is currently ‘behind the curve.’

U.S. Treasury Secretary Scott Bessent reportedly said Tuesday that President Donald Trump would support higher interest rates if inflation became a problem, as markets brace for the Federal Reserve to deliver its first interest rate cut of the year.

“President Trump’s very sophisticated economically, and I think he has been right at almost every turn, whether it’s his first term, his second term,” Bessent said in a CNBC interview. “If he thought inflation were the problem for the American people, sure, he’d be willing to have a rate hike.”

For now, Bessent argued, the issue lies with the Fed. “The problem has been that the Fed has been behind the curve,” he said. “We’re hoping they will start catching up in a rather fulsome way.”

Markets widely expect the central bank to cut rates by 25 basis points at the conclusion of its two-day Federal Open Market Committee (FOMC) meeting on Wednesday. Bessent said the key question is whether policymakers aim to move policy toward neutral or shift to a more accommodative stance.

“I don’t think he thinks that’s neutral. I think he thinks that’s accommodative,” Bessent said of Trump’s call for a 300 basis point cut. “And I know he thinks the Fed is behind the curve.”

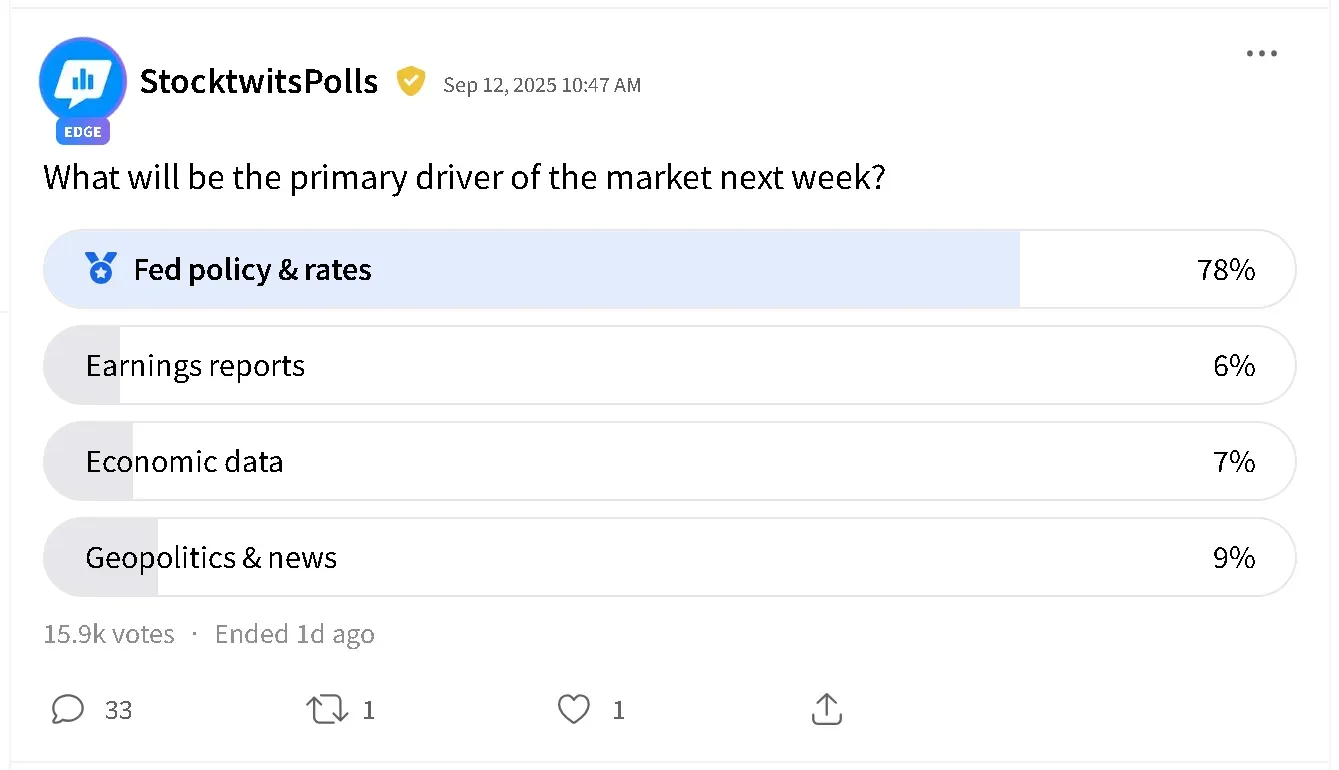

According to a poll conducted on Stocktwits last week, the Federal Reserve’s move on policy and rate cuts is going to be the primary driver behind markets this week.

U.S. equities were cautiously optimistic in pre-market trade on Tuesday. The SPDR S&P 500 ETF (SPY) was up 0.14%, the SPDR Dow Jones Industrial Average ETF (DIA) edged 0.01% higher, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) moved 0.19% higher. Retail sentiment around QQQ on Stocktwits moved higher within ‘bullish’ territory over the past day.

Read also: Bitcoin, Ethereum Trade Cautiously Ahead Of Fed Meeting – Congress To Weigh BTC Reserve

For updates and corrections, email newsroom[at]stocktwits[dot]com.<