Although Bessent did not go into the details, he implied that the Trump administration is eyeing measures such as standardizing local building and zoning codes and decreasing closing costs.

As the U.S. housing market is in a state of flux, characterized by a falling demand amid affordability challenges and soaring prices, the Trump administration is reportedly planning to announce a national housing market emergency for the first time since the 2008 housing market crash.

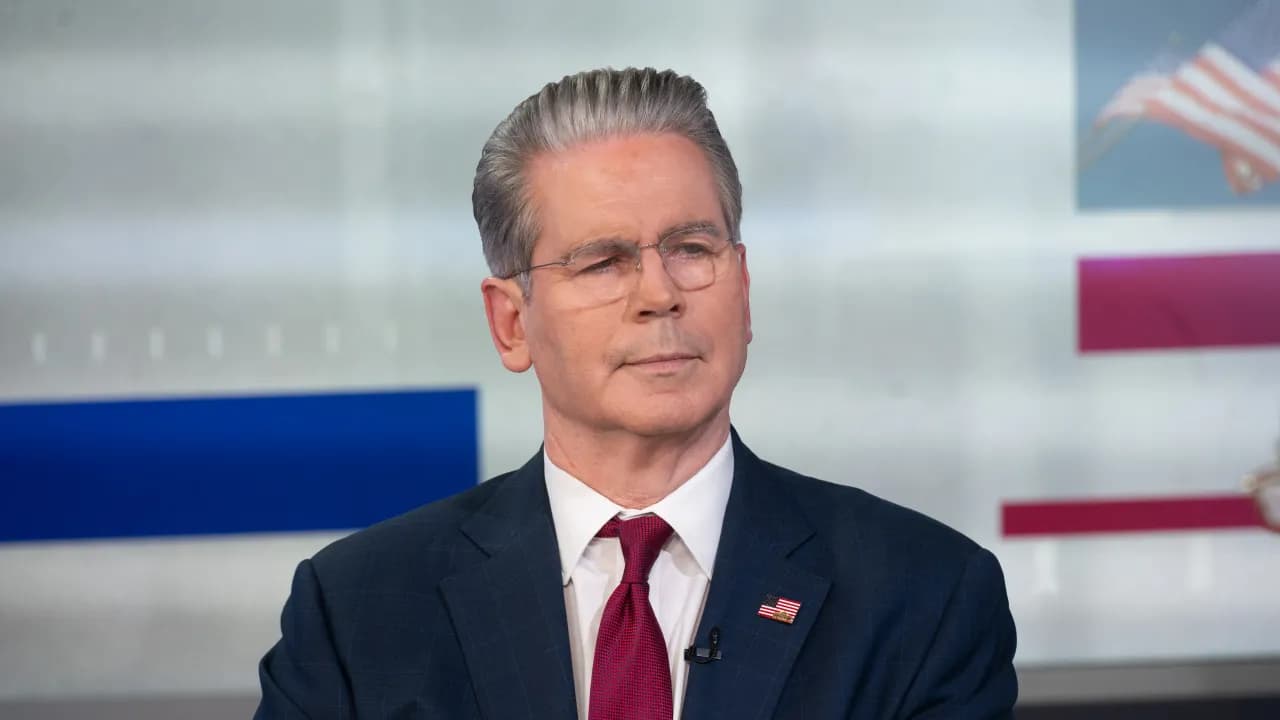

Treasury Secretary Scott Bessent discussed the housing market in two separate interviews, hinting that President Donald Trump was planning to announce a set of measures to reinvigorate the housing market.

In an interview with the Washington Enquirer, Bessent said, “We’re trying to figure out what we can do, and we don’t want to step into the business of states, counties, and municipal governments,” Bloomberg reported.

“We may declare a national housing emergency in the fall.”

Commenting on the development, economist Jon Hartley, a policy Fellow at policy think tank Hoover Institution, said, “Declaring a national housing emergency is a terrific idea & one that is overdue. Bravo @SecScottBessent.’

The SPDR S&P Homebuilders ETF (XHB) has gained 9.62% this year compared to the 10.7% gain for the SPDR S&P 500 ETF Trust (SPY). On Stocktwits, retail sentiment toward XHB was ‘neutral’ (45/100) by late Sunday, worsening from the ‘bullish’ mood seen a day ago.

The Treasury Secretary suggested that housing affordability would be a key issue in the Republicans’ 2026 midterm election campaign.

Although Bessent did not go into the details, he implied that the Trump administration is eyeing measures such as standardizing local building and zoning codes and decreasing closing costs.

A declaration of emergency would enable the president to pass legislation without requiring it to be approved by Congress.

Trump has been blaming the Federal Reserve, led by Jerome Powell, for the current state of the housing market. The Federal Reserve has kept interest rates elevated in the current monetary policy cycle, citing the stubbornly high inflation.

The Fed’s policy rate is the benchmark interest rate against which mortgage rates are set.

Separately, Bessent stated in a Reuters interview that the government plans new measures to address high housing costs in the coming weeks. He described the situation as an “ all hands on deck” challenge.

That said, the Treasury official saw signs of improvement. Rents were dropping, he said, adding that he expects real estate transactions and home sales to increase once interest rates begin to fall.

Bessent said the Trump administration was considering ways to simplify permitting and encourage standardization to boost construction. These measures would increase supply and, in turn, bring down prices.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<