The per share purchase price represents an equity value of $227 million and a premium of about 72% from the stock’s closing price on Tuesday.

Shares of TrueCar (TRUE) rallied 60% on Wednesday morning after the company said that it has entered into a definitive agreement under which Fair Holdings, Inc., an entity led by TrueCar founder Scott Painter, will acquire the company in an all-cash, go-private transaction at $2.55 per share.

This represents a premium of about 72% from the stock’s closing price on Tuesday and amounts to an equity value of approximately $227 million based on current basic shares outstanding.

TrueCar said that Fair Holdings is negotiating with various financial and strategic investors to syndicate the financing of the deal with equity investments.

TrueCar Chair Barbara Carbone said that the board unanimously approved the transaction after a thorough and careful evaluation. “…we are confident it is in the best interest of TrueCar stockholders and other stakeholders,” they added.

Upon completion of the deal, Scott Painter will be the CEO of the company again, it said. The transaction is expected to close in the fourth quarter of 2025 or early 2026, subject to the receipt of certain approvals. Once the deal is completed, TrueCar will no longer trade on the bourse.

However, if Fair Holdings is unable to complete the transaction, it has agreed to pay a reverse termination fee to TrueCar, the company said.

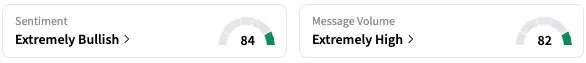

On Stocktwits, retail sentiment around TRUE stock jumped from ‘neutral’ to ‘extremely bullish’ over the past 24 hours, while message volume rose from ‘normal’ to ‘extremely high’ levels.

A Stocktwits applauded the buyout as a “good deal.”

Another, however, opined that the price is low.

TRUE stock is down by 36% this year.

Read also: Rigetti Computing Stock Slides 8% After Hitting Record Highs On Tuesday — Traders Warn Of More Downside

For updates and corrections, email newsroom[at]stocktwits[dot]com.<